Second Stimulus Check: When It’s Coming and How You Can Receive Yours as Quickly and Safely as Possible

The IRS began sending a second round of direct stimulus payments during the last week of December. Most adults making $75,000 or less will qualify for the full $600. For many, the money couldn’t come sooner, but one question remains:

When will you get yours?

The vast majority of people who are entitled to a payment don’t need to take any action to receive it. Still, it’s smart to check the status of yours to ensure no mishaps occur.

To confirm the status of your check, use the official IRS payment tool. Here are five steps to do it.

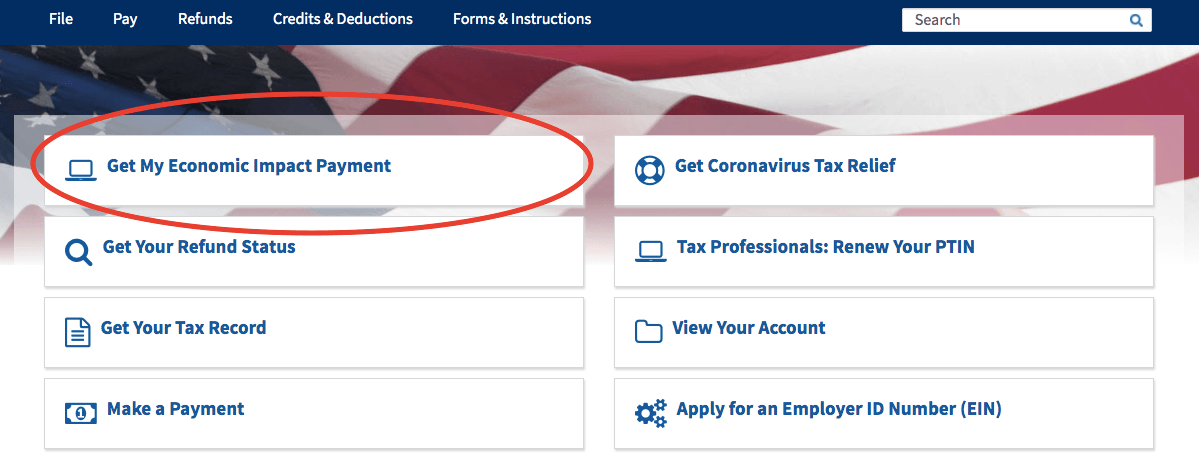

Step 1: Visit the IRS website

Visit the IRS website at www.IRS.gov. Click on “Get My Economic Impact Payment.”

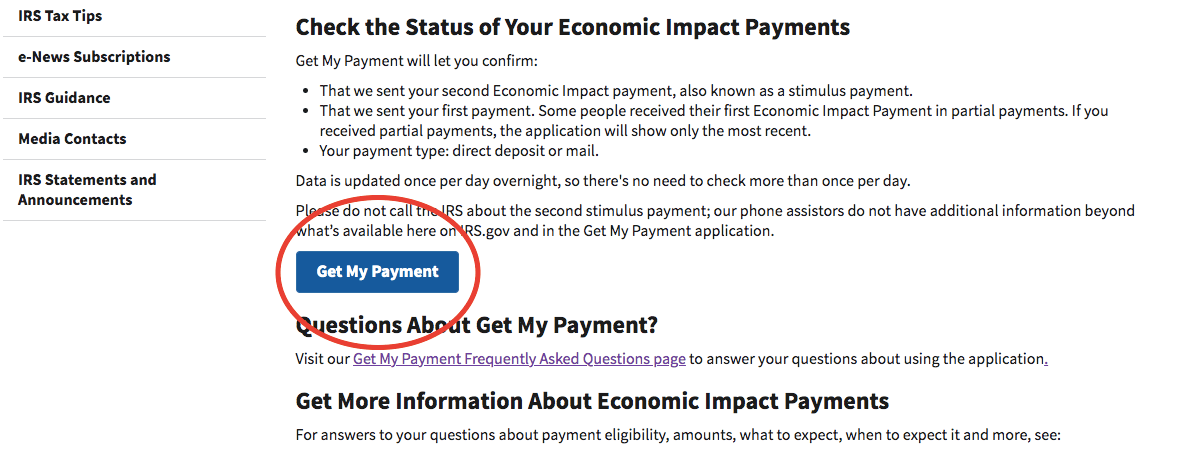

Step 2: Click “Get My Payment”

Use the IRS Get My Payment tool to check the status of your payment. This tool will help you determine when you can expect to receive your payment and how it will be sent — either direct deposit or mail. Start by clicking “Get My Payment.”

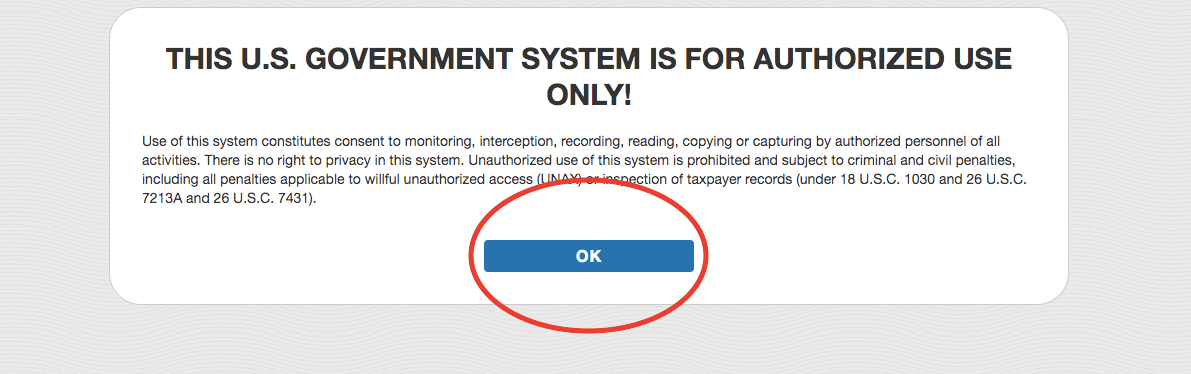

Step 3: Agree to terms

To access the tool, you need to confirm that you’re using it to check the status of your payment and not for some other unauthorized purpose. Click “OK” to continue.

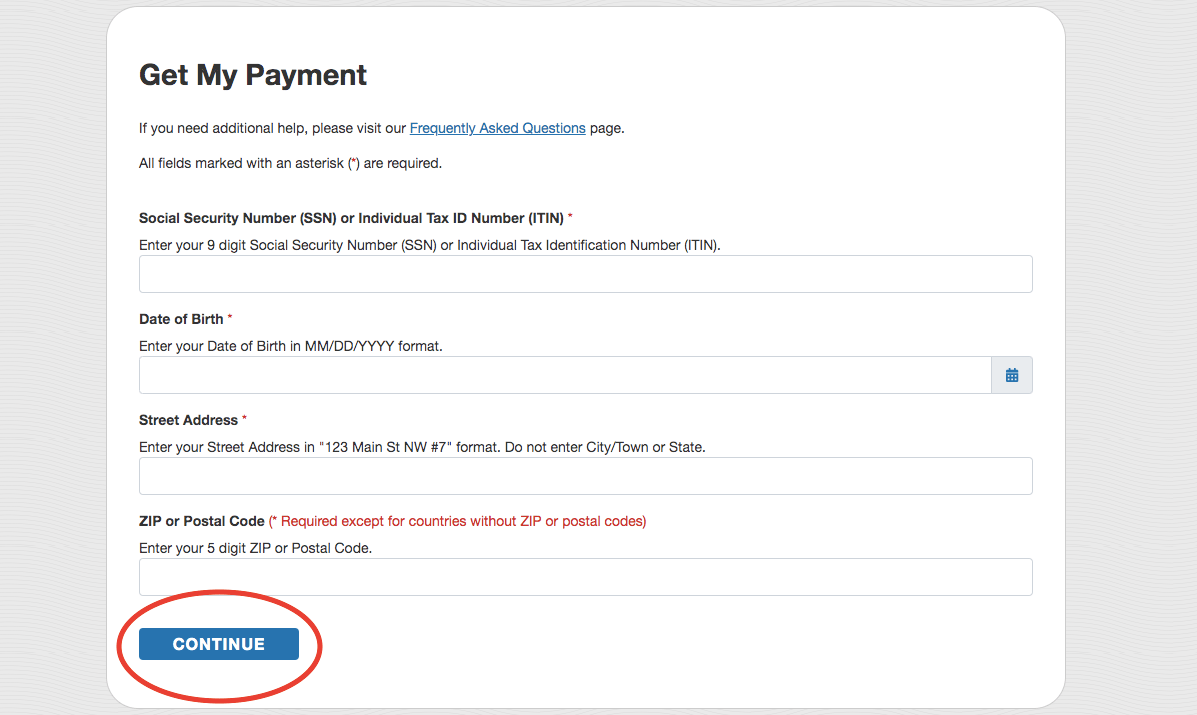

Step 4: Enter your information

Next, you’ll be asked to provide the following information:

- Social Security number

- Date of birth

- Address

Once you enter it, click “Continue.”

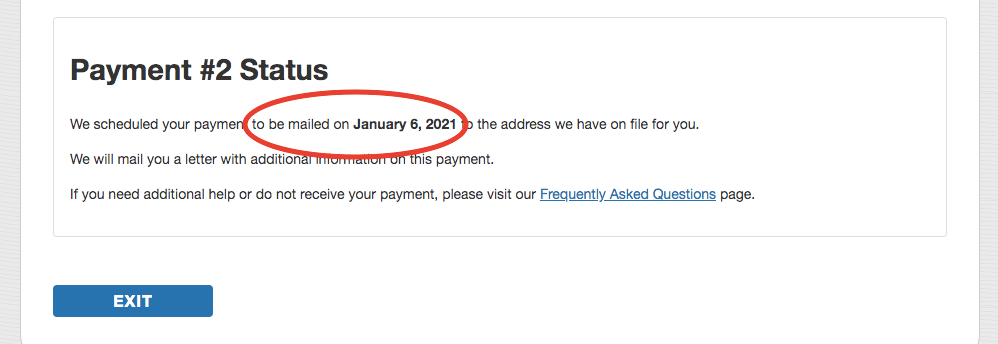

Step 5: Get your payment status

You should now see your payment status. (If not, proceed to step 6.) It will tell you when your payment will be sent and how you’ll receive it.

Step 6: Troubleshoot (if needed)

Some users may encounter problems with the Get My Payment tool. Two common issues are information errors and an unavailable status.

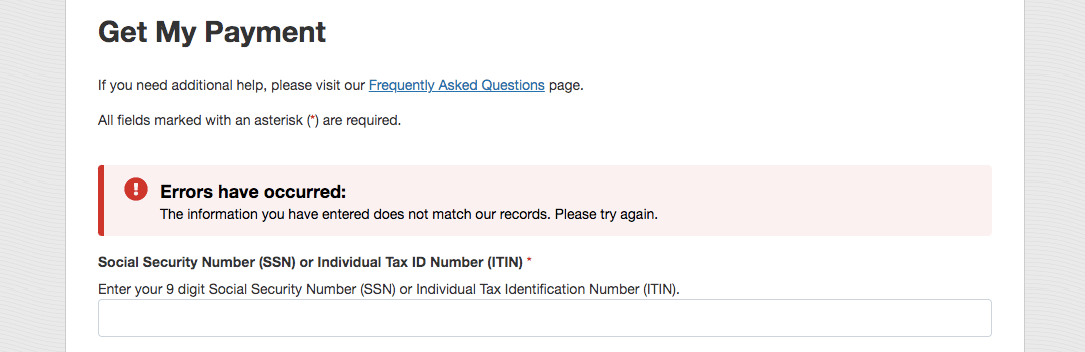

Information errors

This problem can occur when the personal information you enter in step 4 is different (even just slightly) than the information the IRS has on file for you. It will generate an error message that reads “Errors have occurred: The information you entered does not match our records. Please try again.”

If you encounter this problem, try the following:

- Carefully re-enter your information to make sure you typed it correctly.

- Make sure you enter your information in the specified format. For instance, your birthday must be provided as follows: MM/DD/YYYY.

- Try different abbreviations for your address. For instance, if your address is 123 North 1st Place, enter it as 123 N. 1st Place, or 123 North 1st Pl. Your address must match the IRS records exactly.

- Use the USPS ZIP lookup to get the official version of your address and try that.

- Review your latest tax return and copy your personal information into the Get My Payment tool to ensure an exact match.

For security reasons, you only get three attempts per day to correctly enter your information. After that you’ll be locked out of the system and will need to wait 24 hours to try again. You can read more about information errors on the IRS website.

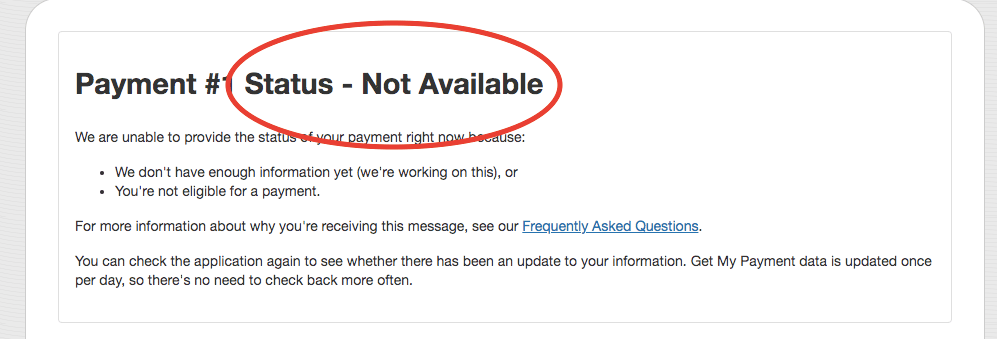

Status not available

When you receive your payment status, you may see a message that reads ”Payment #2 Status - Not Available.” This can occur for several reasons.

One common reason you may receive this message is because you don’t qualify for the second stimulus payment. Check the eligibility requirements on the IRS website to determine if this is the problem.

Another common reason you may receive this message is because you didn’t file a 2018 or 2019 tax return. This can also be a problem if you recently filed your tax return but the IRS hasn’t processed it yet.

You can read more about unavailable-status issues on the IRS website.

Bottom line

The second round of stimulus checks is on its way. Most Americans who qualify don’t need to take any action to receive them. Still, it’s a good idea to check the status of yours to ensure it arrives promptly and safely.