Does the Debt Snowball Method Work?

The average American household carried an average of $5,315 in credit card debt in 2023. From student loans to credit card and mortgage debt, many Americans have some personal loans to pay each month in addition to their regular costs of living.

Carrying a lot of debt can be extremely stressful. Juggling debt may lead to having less money for other expenses, accumulation of high-interest payments, and a poor credit score.

If your debt is keeping you up at night, there are options to get the ball rolling on a bite-size payoff plan known as the debt snowball method.

What is the debt snowball method?

The debt snowball method, which was popularized by personal finance guru Dave Ramsey, involves paying off your smallest debt first, regardless of the interest rate, by following these steps:

- Make a minimum payment on all your debts every month.

- In addition to the minimum payment on your smallest debt, also pay off an additional amount that you can afford, even if it's small.

- Once you pay off the balance on your smallest debt, follow the same repayment plan with the next lowest balance. However, be sure to add the monthly payment amount you were putting towards the first balance to your new lowest payment.

- Continue this process with each debt. Eventually, you’ll reach the highest amount and pay it off.

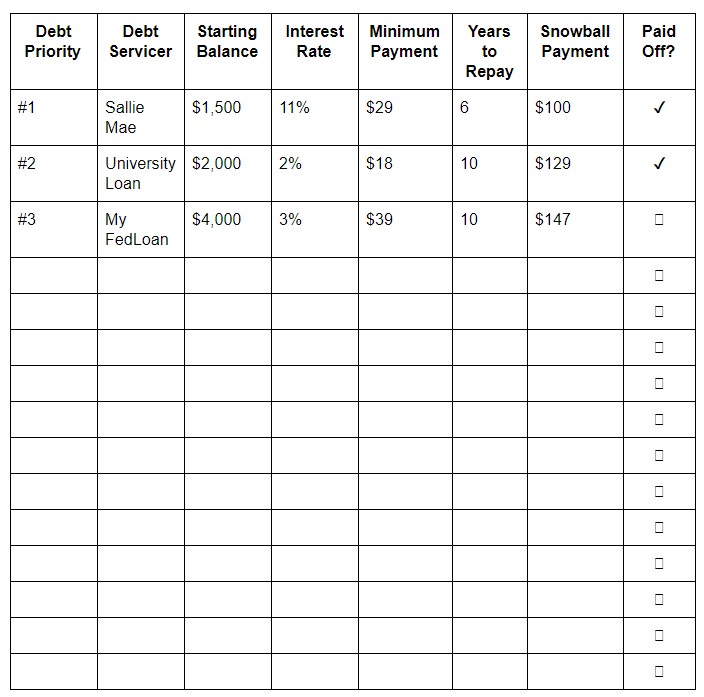

Here’s an example of how the debt snowball method works:

Assuming you have a credit card balance of $500 and decide to pay $50 on top of your minimum payment of $25. Your total monthly payment is now $75. Once you have paid off the $500 debt, take the $75 you were putting toward it each month and use it to tackle your next smallest debt.

For example, let’s say the minimum monthly payment on your next debt is $35. Your total toward repayment each month would be $110 ($35 + $75). Keep repeating this process until you pay off your debt, and then move on to the next smallest one.

To best illustrate how the debt snowball works, let's take the example of a hypothetical man named Bill. When Bill tallied all of his loans and credit cards, he discovered he had $44,500 in debt. This was negatively affecting Bill's credit score, so he decided to pay off his debt using a debt snowball.

Bill began by organizing all of his debts in order from smallest to largest. He made sure to also include the minimum payment for each debt. His spreadsheet looked something like this:

| Name of Loan | Principal | APR | Monthly Minimum |

|---|---|---|---|

| Department Store Card | $1,500 | 13% | $31.25 |

| Credit Card A | $3,000 | 19% | $77.50 |

| Personal Loan | $8,000 | 15% | $322.00 |

| Car Loan | $15,000 | 9% | $362.5 |

| Credit Card B | $17,000 | 14% | $368.33 |

According to his chart, Bill was already spending $1,161.58 per month by paying just the monthly minimum. By trimming back his spending, Bill was able to set aside $2,000 a month for debt repayment. This left him with an extra $838.42 beyond the monthly minimum payments to start paying off his debt.

Bill's smallest debt was his Department Store Card, which had a $1,500 principal balance. He took the $838.42 in extra funds and added it to the monthly minimum payment of $31.25. This meant he was paying a total of $869.67 per month. In two months, Bill's Department Store Card was entirely paid off.

At that point, Bill took the $838.42 in extra funds and the $31.25 that he was no longer paying towards his Department Store Card, adding both of those to the $77.50 monthly minimum on his next largest debt, Credit Card A. Each month, he was now paying $947.17 towards that $3,000 principal. In four months, that principal was $0.

Continuing in this fashion, it took Bill seven months to pay off his $8,000 Personal Loan, 10 months to pay off his $15,000 Car Loan, and nine months to pay off his $17,000 Credit Card B. All-in-all, it took him 32 months, a little under three years, to fully pay off his debt.

Here is a visual example of how the snowball method works:

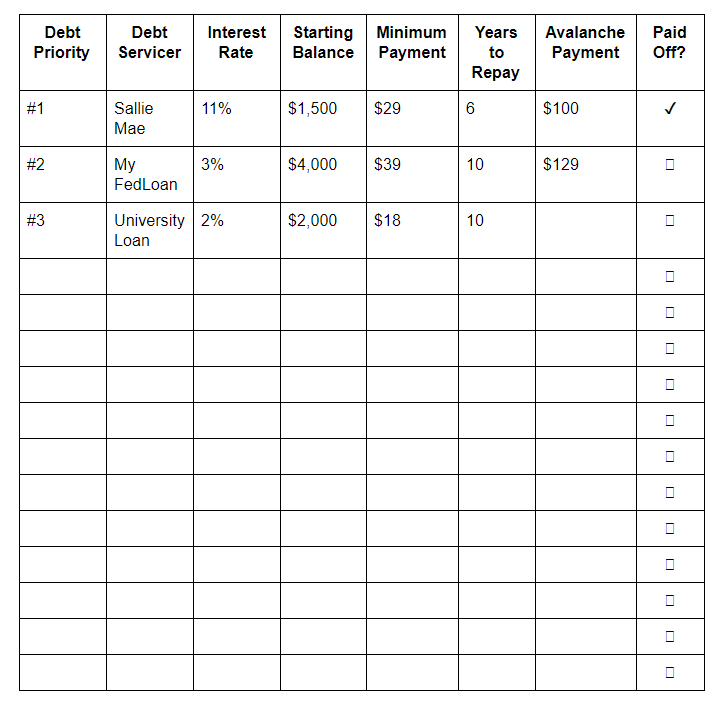

What is the debt avalanche method?

The debt avalanche method is the opposite of the debt snowball method, focusing on long-term costs instead of quick wins. The only similarity is that you pay off the minimum on all your debts every month and choose to tackle one debt with additional funds.

However, this time you chip away at the debt with the highest interest rate first. Follow the same practice of putting a certain amount toward your highest-interest debt each month, then move on to the second-highest, rolling over your previous payment into that one, until you go down the line and eventually make all your debt repayments.

Here is an example of the debt avalanche method:

Debt snowball method vs. debt avalanche method

The debt snowball plan works better for some people on a psychological level. “I often assist clients with the debt snowball method for two main reasons: motivation and simplicity,” said Ben Watson, founder of Fiscal Fluency. “Often, people struggling with multiple debts feel overwhelmed and frustrated that they’re not making much progress, if at all, in paying down the money they owe. By creating a plan to tackle the smallest balance first, they can quickly see traction and become motivated to pay it off faster.”

There is a drawback to this method: By paying off the debt with the lowest principal instead of the one with the highest APR (like you would in the debt avalanche method), you may end up paying more for your bills in the long run. However, Dave Ramsey has been quick to point out that one of the major benefits of the snowball method is how it rewards people with early successes. Paying off the first debt feels good, really good. And that feeling encourages people to stick with the occasionally painful process of living below their means.

If you’re in a situation where you don’t have much expendable income every month, then you may find that debt snowball works better for you than the debt avalanche method. “For those living paycheck to paycheck, it is likely that the avalanche method won’t work, as you have likely been making only minimum payments since you went into debt in the first place,” said Robyn Flint, a writer for Loans.org. “So the debt snowball will likely create more success and momentum at clearing debt off of your credit report.”

Still, if you can, other experts recommend the avalanche debt method since it makes more sense financially. “While someone is using the snowball debt method, they could be racking up significant amounts of interest because they aren't paying off the debts with the highest interest rate first,” said Rebecca Hunter, CEO of The Loaded Pig.

While both the debt snowball plan and the debt avalanche method are effective, trying each one to see which helps you pay off debt faster may be your best bet. “It’ll likely be the one that motivates them that provides the greatest benefit," Watson says.

Climbing out of debt faster

To speed up the debt payoff process, create a budget according to your paycheck. Freya Kuka, owner of the personal finance blog Collecting Cents, says you can use a calendar to write down upcoming expenses for the month, give every dollar a job, and utilize the envelope system to put the allocated cash for every category into its own envelope.

Kuka also recommends deleting your credit card information from online stores, since it’s much easier to spend online when your information is already saved in their system. Cut any unnecessary expenses and aim not to take on any more debt. These moves will help you to climb out of debt faster than if you didn't find a way to curb your spending habits.

“The quickest way to pay off debt is to increase your income and decrease spending,” Watson said. “A lot of time people focus only on one by either cutting discretionary spending or working extra hours. Combining the two will speed up your debt-free date.”

Please note the below article contains links to external sites outside of OppU and Opportunity Financial, LLC. These sources, while vetted, are not affiliated with OppU. If you click on any of the links you will be sent to an external site with different terms and conditions that may differ from OppU’s policies. We recommend you do your own research before engaging in any products or services listed below. OppU is not a subject matter expert, nor does it assume responsibility if you decide to engage with any of these products or services.