Pretax Savings Options to Help Your Bank Account

When you receive a paycheck, you may notice your pay stub shows deductions like income tax, Social Security, 401(k) contributions. Your employer may opt to deduct these expenses directly from your gross pay to help you save money. These deductions, which ultimately lower your take-home pay, are also referred to as pre-tax payroll deductions.

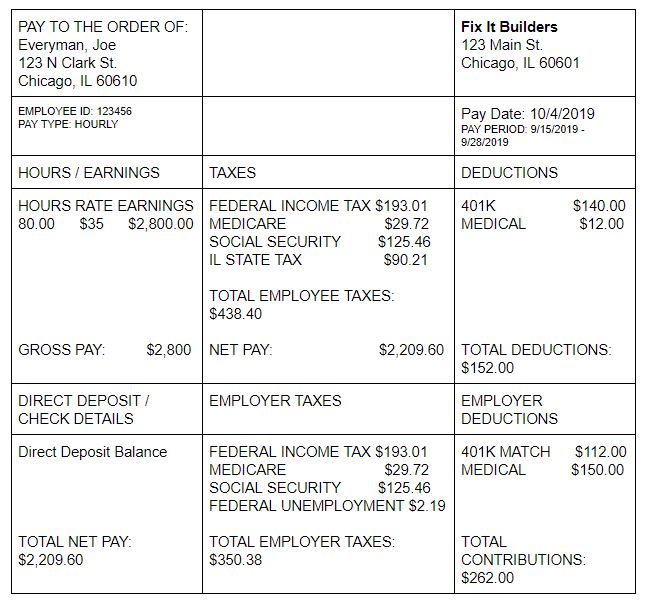

You can view how these deductions appear on your pay stub in the OppU example below:

While pretax payroll deductions appear to impact the final dollar amount going into your checking account, they don't necessarily translate to less money for you or your family. In fact, these deductions can help you save money.

Confused? Let's break it down.

What does "pre-tax" mean?

The term "pre-tax" means your deductions; such as health insurance premiums and retirement contributions, are taken out of your paycheck before any state or federal taxes are withheld. This reduces your taxable income and the amount owed to the government when Tax Day comes around.

For instance, let’s say that you make $1,200 every two weeks. Your employer subsidizes your health care, but your contribution to the insurance plan is $100 per pay period. In this scenario, your employer subtracts $100 from your paycheck as a pre-tax deduction for your health care plan. In turn, the government taxes $1,100 of your pay instead of the full $1,200 you earned, which lowers your overall tax burden.

Generally speaking, pre-tax deductions consist of things like:

- Your retirement plan, such as a 401(k)

- Health insurance (medical and dental plans)

- Health savings accounts (HSAs) and flexible spending accounts (FSAs)

- Group-term life insurance

- Commuter benefits you receive from your employer

Post-tax deductions may include:

- Wage garnishments for debts you owe

- Charitable contributions

- Small business retirement funds, such as a Roth 401(k)

- Disability insurance

Your deductions will vary based on your employer and the benefits you selected for the year.

Learn How To Save Money

With Zogo, financial education is informative and rewarding. Start your journey to financial mastery today and see where Zogo can take you!

Discover practical ways to save money.

Benefits of pre-tax deductions

You may have a choice between pre-tax or post-tax deductions when you select your benefits. Pre-tax deductions are typically better because you will owe less in taxes upfront. They will lower your Social Security payments and Medicare costs, which are included in the Federal Insurance Contributions Act tax (FICA). Additionally, there is also a benefit for employers since pre-tax deductions will lower the amount they pay in State Unemployment Insurance (SUI), FICA taxes, and the Federal Unemployment Tax (FUCA). Note: when you file your taxes, you will not be able to claim your pre-tax deductions on your income tax return because you have already taken advantage of the tax benefit.

While receiving a smaller paycheck every month may not be ideal, the overall tax savings could be worth a lot more than what you could save from your income on your own. For instance, you may spend your entire paycheck, while pre-tax deductions automatically put your money into designated buckets. Additionally, you’ll also probably pay less for employer-sponsored health care with your pre-tax deductions compared to buying private health care with your after-tax money.

However, there is a limit to the amount of money you can withhold from your paycheck. Also, your employer may not offer the type of retirement account or investment that you want.

Pre-tax deductions may change from year to year depending on government regulations.

Making pre-tax investments

One of the main reasons people choose to participate in pre-tax deduction benefit programs is to build up their retirement savings over time. Pre-tax investment accounts are funded with your pre-tax dollars, and they include:

- HSA

- Traditional IRA

- Thrift Savings Plan

- 401(k)

- 403(b)

It’s a good idea to set up a 401(k) with your employer, especially if they have a matching program. This will automatically save for retirement savings with each paycheck and receive additional contributions from your employer. If you work for a tax-exempt organization or a public school, you can sign up for a 403(b), which is similar to a 401(k). Alternatively, a traditional IRA is another option, but your employer may not offer to match your contributions.

The government allows for pre-tax deductions to help avoid burdening the government by applying for assistance post-retirement. Taxes on retirement savings are deferred until withdrawal. If you are a high earner now, this will allow you to pay potentially less taxes if your income decreases during retirement.

Another benefit is that you typically do not have to pay tax on the interest, dividends, or capital gains associated with these accounts, unlike regular investments.

Deciding on pre-tax vs. post-tax investments

While the benefits of pre-tax investments are obvious, you should look at the whole picture before making a decision. For example, The Simple Dollar’s Trent Hamm points out in his blog:

“If your employer is matching your contributions to one of your retirement savings accounts, the value of that extra employer contribution money is going to blow away any tax benefits. It’s not even close.”

Therefore, you should consider taking advantage of employer retirement contribution benefits.

If you do invest in post-tax benefits, like a Roth IRA, you won’t have to pay taxes when you withdraw upon retirement. It depends on whether you want to pay taxes now or later.

Talking with your employer, accountant, and/or financial advisor will help you make an informed decision.

Please note the below article contains links to external sites outside of OppU and Opportunity Financial, LLC. These sources, while vetted, are not affiliated with OppU. If you click on any of the links you will be sent to an external site with different terms and conditions that may differ from OppU’s policies. We recommend you do your own research before engaging in any products or services listed below. OppU is not a subject matter expert, nor does it assume responsibility if you decide to engage with any of these products or services.