How Is Your Credit Score Determined?

Your credit score is an important part of your financial life. From credit cards to mortgages, it can determine whether or not you get approved and how much you’ll pay in interest if you do. If you’re like many people, you probably have an idea of what your score is. But here’s another question that might be even more important:

Do you know how your credit score is determined?

Don’t go anywhere just yet. When you know how your credit score is calculated, you know what factors contribute to a good score and what factors can drag it down. While not everything is available to the public, the two companies that produce the most common credit scores — FICO and VantageScore — provide general guidelines about what they use to determine your score. Here’s what we know.

How is your credit score determined?

Your credit score is determined using a mathematical formula called a scoring model. The two most common scoring models were developed by FICO and VantageScore. Each produces its own score — a FICO score and a Vantage score.

To calculate your score, FICO and VantageScore look at your credit report. They use the data to produce a number between 300 and 850, with a higher number indicating greater confidence in you as a borrower. When you apply for a loan or credit card, many lenders will look at this number. A higher score will count in your favor, allowing a better chance you’ll be approved and receive an optimal interest rate.

FICO and Vantage scores are calculated differently. Certain aspects of your credit report might be more important for one than the other. FICO is the most common scoring model. VantageScore might be used for borrowers with newer or dormant credit histories.

How is your FICO score determined?

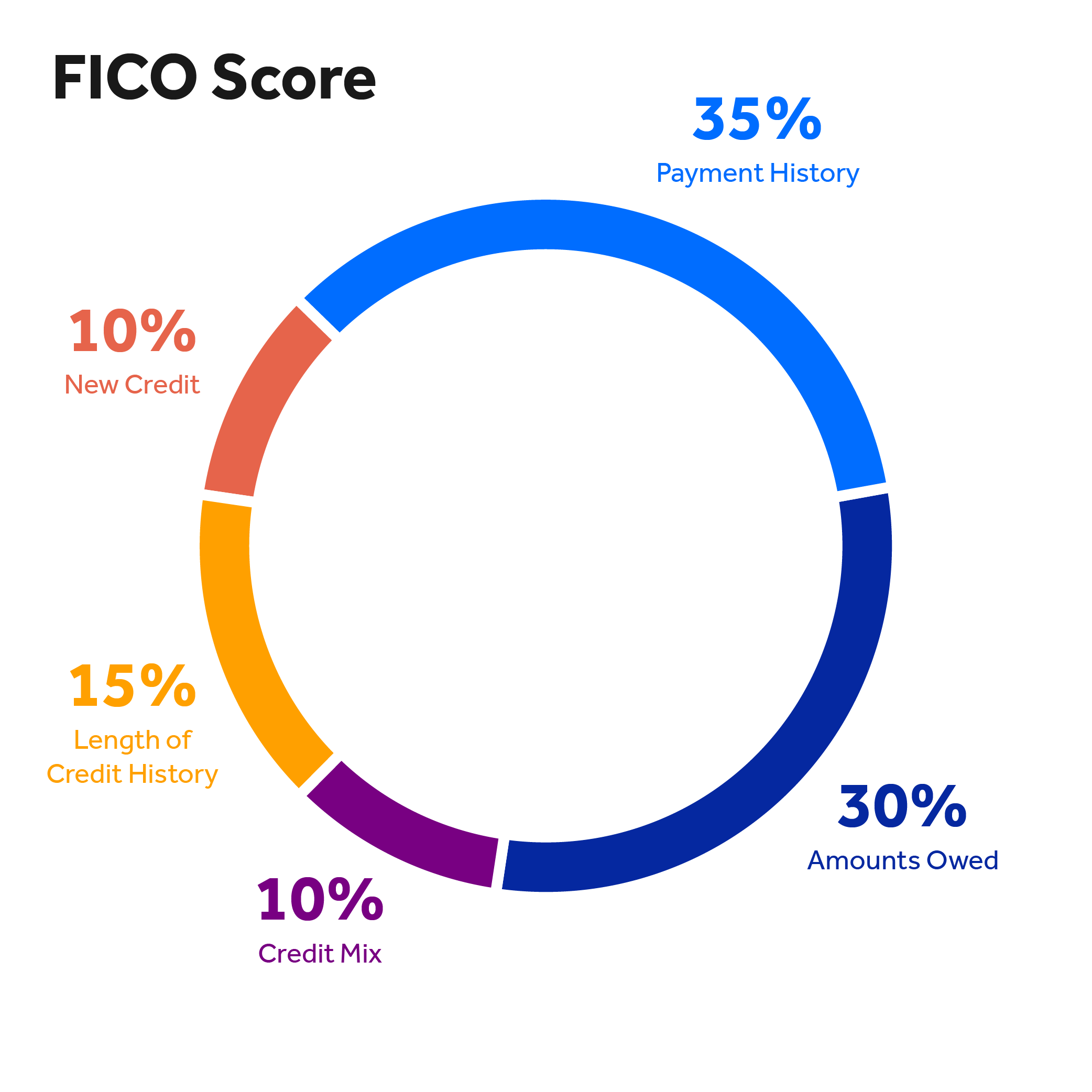

FICO uses five main categories of data from your credit report to determine your score. Each category is assigned a different value, with some contributing to your score more than others. The categories are:

- Payment history

- Amounts owed

- Length of credit history

- Credit mix

- New credit history

Payment history

Payment history is the most important factor used to determine your FICO score — it makes up 35% of it. It typically includes loans, credit cards, and any lawsuits or bankruptcies.

Paying bills on time and getting current on missed payments are two of the best things you can do to build a good payment history. When assessing payment history, FICO looks at the following:

- Your record of payments

- How long any missed payments went unpaid

- How much you still owe on delinquent accounts

- How many missed payments you have on your credit report

- Whether you have any bankruptcies

- How much time has passed since any negative items occurred

- The number of accounts you have in good standing

Amounts owed

This makes up 30% of your FICO score. When assessing your amounts owed, FICO looks at the following:

- The total amount you owe on all of your accounts

- How much you owe on different types of accounts — for example, credit cards versus a mortgage

- How many accounts have balances

- How much of your total available credit you’re using on revolving accounts such as credit cards

In general, it’s a good idea to keep debt low, especially for credit cards. Most experts recommend limiting credit card use to 30% or less of your credit limit.

Length of credit history

The length of your credit history makes up 15% of your FICO score. A longer credit history may have a positive effect on your score.

When assessing the length of your credit history, FICO looks at the following:

- The age of your oldest account

- The age of your newest account

- The average age of all your accounts

- How long it’s been since you’ve used an account

- How long specific accounts have been open

Credit mix

Credit mix makes up 10% of your FICO score. It impacts your score less than more important factors like payment history and amounts owed, but it can still play a role.

When assessing credit mix, FICO looks at whether you have experience with both forms of credit: revolving and installment. Here are some common examples of each:

Revolving credit

- Credit cards

- Retail cards

- Gas cards

- Home Equity Line of Credit (HELOC)

Installment credit

- Mortgages

- Auto loans

- Student loans

A combination of both on your credit report may count in your favor.

New credit

New credit makes up 10% of your FICO score. When assessing new credit, FICO considers the following:

- The number of new accounts you have

- The number of recent inquiries you have

- The length of time since you last opened an account

Since new credit only accounts for 10% of your score, it’s less important than other factors. However, when you open a new account, you can negatively impact your score in a couple of ways. One, you reduce the length of your credit history. And two, when you apply for credit, the lender will often check your credit report, and these inquiries can lower your score, though usually only by a few points.

How is a VantageScore determined?

Like FICO, VantageScore uses the information in your credit report to determine your score. Its model analyzes the data, and just like FICO, attempts to predict how likely you are to pay back a loan.

While FICO and VantageScore measure the same thing, they go about it differently and may assign different levels of importance to different portions of your credit report. The five main categories of information that may impact your VantageScore are:

- Total credit usage, balance, and available credit

- Credit mix and experience

- Payment history

- Age of credit history

- New accounts

VantageScore 4.0

| Category | Influence Level | Borrower Tips |

| Total credit usage, balance, and available credit | Extremely influential | Keep balances under 30% |

| Credit mix and experience | Highly influential | Diversify types of credit accounts |

| Payment history | Moderately influential | Pay all bills on time |

| Age of credit history | Less influential | Closing accounts may hurt your score |

| New accounts | Less influential | Don’t open too many accounts too quickly |

The bottom line

Your FICO and VantageScore credit scores are determined using data in your credit report. Some parts of your report are more important than others, and the two entities may weigh them differently. Generally, good financial habits like paying bills on time are good for both.

Please note the below article contains links to external sites outside of OppU and Opportunity Financial, LLC. These sources, while vetted, are not affiliated with OppU. If you click on any of the links you will be sent to an external site with different terms and conditions that may differ from OppU’s policies. We recommend you do your own research before engaging in any products or services listed below. OppU is not a subject matter expert, nor does it assume responsibility if you decide to engage with any of these products or services.