‘Should I Buy This?’ A Financial Flowchart for Smart Spending

Ever feel like you have a hole in your pocket? Money doesn’t magically disappear, even if it feels that way. Every purchase adds up, and they’re the result of decisions — some smart, some not so smart.

You can change that.

Learn How To Shop Smartly

With Zogo, financial education is informative and rewarding. Start your journey to financial mastery today and see where Zogo can take you!

Learn how to make informed purchasing decisions.

To make good spending decisions, ask yourself the right questions before reaching out for your wallet. This will help you avoid the type of spending that ruins your budget and will help you free up money for saving and other important goals.

Ready to get started?

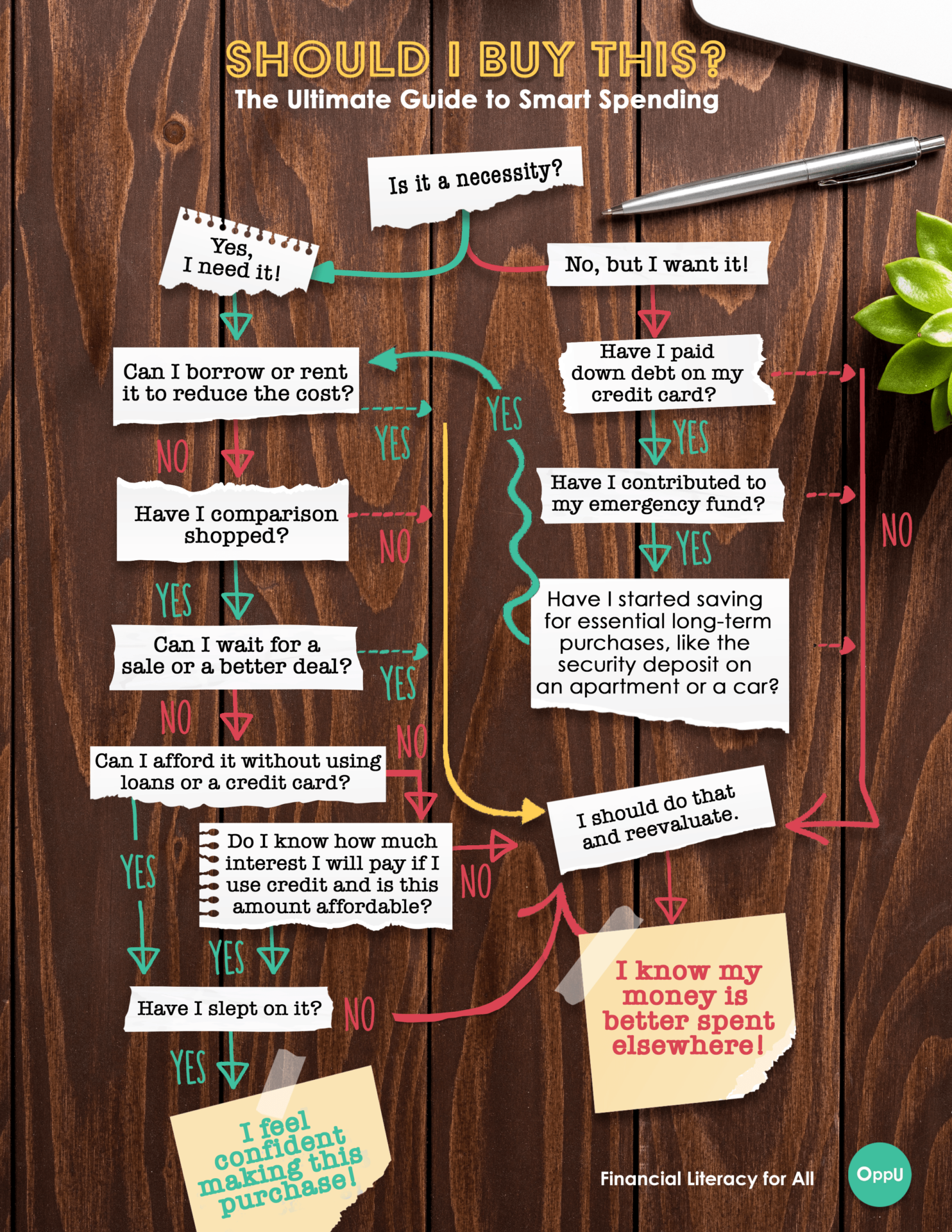

Here are five questions to ask yourself before you spend, and a flowchart developed by personal finance expert Beth Tallman to guide you through the decision-making process.

DOWNLOAD THE FINANCIAL FLOWCHART

5 Questions to Ask Yourself Before You Spend

No. 1: Is it a necessity?

Ask yourself if the purchase is a necessity or a want.

A necessity is an essential expense, such as food or housing, and cannot be omitted from the budget, but savvy tactics like comparison shopping can reduce its cost.

On the contrary a want is a non-essential expense, such as eating out or going to a movie. Wants make our lives more enjoyable, but if budget limitations arise, they’re a good place to cut.

Don’t worry: Not all wants need to be eliminated. The trick is to take care of needs and other financial priorities first. After that, wants are fair game and you can spend guilt-free.

No. 2: Are my finances under control?

Consider whether your personal finance essentials are satisfied. Ask yourself:

- Have I paid down debt on my credit card?

- Have I contributed to my emergency fund?

- Have I started saving?

There are three important reasons why debt and savings take precedence over new expenses:

- Debt accumulates interest and the longer you have it, the more expensive it is.

- A healthy emergency fund protects you against debt.

- Saving provides money for future needs.

Basically, these are the things you need to do to reach financial health. Prioritize them before you spend on non-essential items.

No. 3: Can I reduce the cost?

Consider whether you can get a better deal. Ask yourself:

- Can I borrow or rent it?

- Have I comparison shopped?

- Can I wait for a sale?

Savvy shopping strategies can reduce the cost of both necessities and wants. When purchasing groceries, for example, avoid name brands and opt for their generic alternative. Similarly, when buying a video game or an extra pair of shoes, wait for a sale.

No. 4: Will I go into debt?

Taking on debt should be reserved for needs. Once you determine that the expense is essential, ask yourself:

- Can I afford this without relying on loans or a credit card?

- Do I know the interest assessed with using credit and is this amount affordable?

Not all debt is inherently bad. In fact, certain debt can help contribute to improvements in your overall financial health. Student loan debt, for instance, can help you finance an education that may lead to a higher paying career. However, debt will always cost you more due to interest than paying for something outright. It is advisable to use it wisely.

In some cases, debt that doesn’t contribute to your financial health is unavoidable; emergency expenses such as medical care is one example. In these situations, look for a financing option that aligns with your budget.

No. 5: Have I slept on it?

Before you spend, wait. A cooling-off period will help you avoid impulse buys. It will also give you additional time to ensure you make the right decision.

While you wait, reconsider the smart-spending questions. Step away from the decision and clear your head. Come back to it the next day.

A night’s sleep can do wonders. Sleep on it so when you make your decision, you can feel confident knowing it’s the right one.

Beth Tallman is a financial educator, freelance writer, and consultant. She writes on personal finance and financial education, conducts student workshops, and develops educational content. Ms. Tallman is a regular contributor to NextGen Personal Finance.

Please note the below article contains links to external sites outside of OppU and Opportunity Financial, LLC. These sources, while vetted, are not affiliated with OppU. If you click on any of the links you will be sent to an external site with different terms and conditions that may differ from OppU’s policies. We recommend you do your own research before engaging in any products or services listed below. OppU is not a subject matter expert, nor does it assume responsibility if you decide to engage with any of these products or services.