The No-Spend Challenge: Stop Spending and Start Saving

Ready to rein in spending? Try the no-spend challenge.

The no-spend challenge cuts overspending by “fasting” unnecessary purchases. No daily coffee. No retail therapy. However, the upside is practicing discipline that will change your habits for the better. Create a budget that fits your needs and boost your savings.

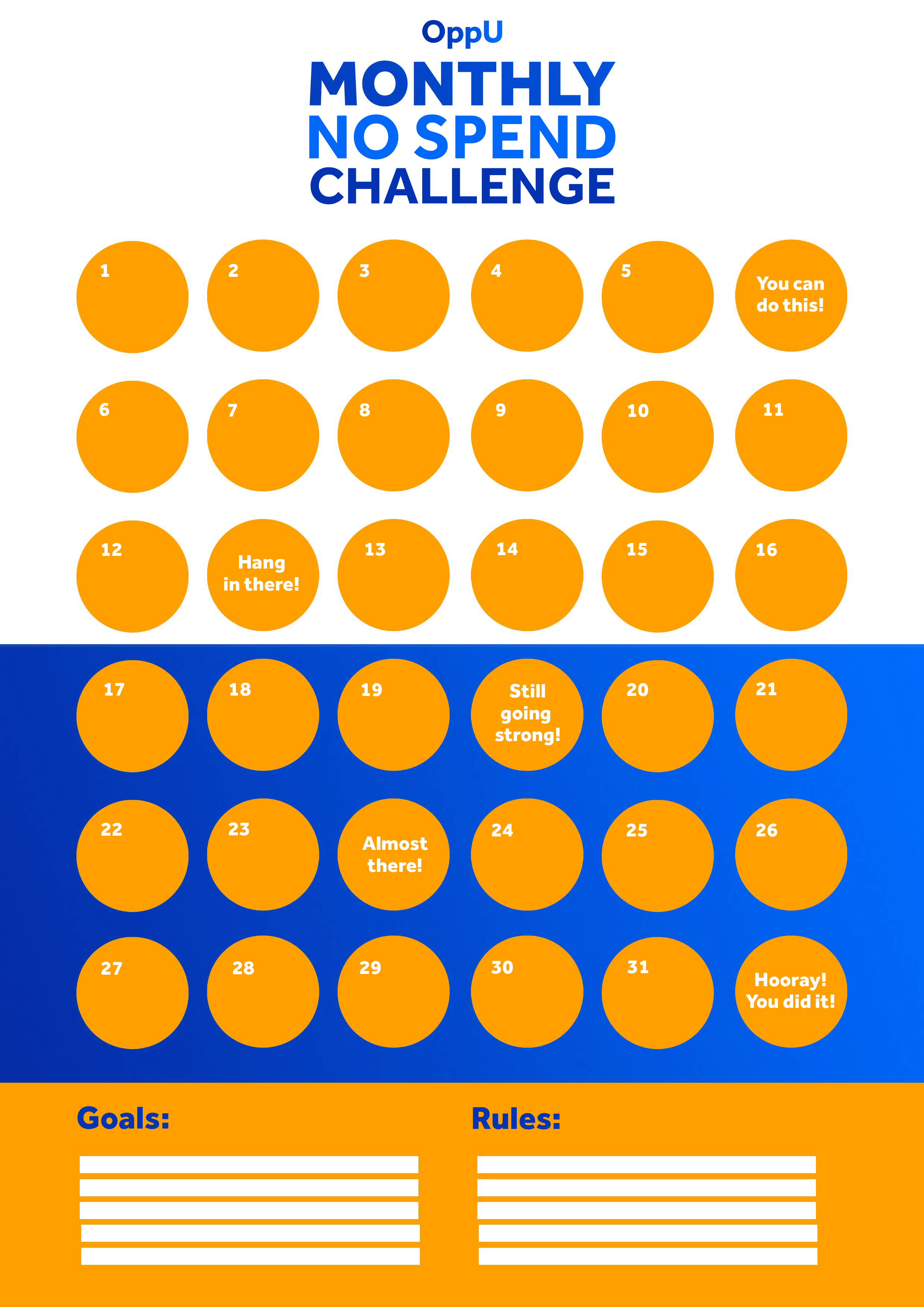

Here’s how to participate in the no-spend challenge. Download our no-spend worksheet to track your success.

DOWNLOAD THE NO-SPEND CHALLENGE WORKSHEET

DOWNLOAD THE NO-SPEND CHALLENGE WORKSHEET

What is the no-spend challenge?

The no-spend challenge is a strategy to stop overspending. It refreshes a budget and prioritizes “needs” over “wants.” Participants must commit to not spending money for a set period of time, like a week or a month.

At the end of the challenge, participants will have reigned in their overspending, changed their financial management habits, and saved extra money.

How does the no-spend challenge work?

For a certain amount of time stop all spending, except for “need” expenses. The goal is to stop reckless spending and start practicing healthy financial behaviors.

Typically, participants will follow the no-spend challenge for one month, but it can last for a shorter or longer amount of time, whether one week or one year.

Establish rules for the challenge. Write down expenses that are allowed — things you need to survive. Write down expenses that aren’t allowed — everything you can live without. Use this time to create a budget that prioritizes “need” expenses and reallocate the “want” expenses to savings, debt, or investments.

Allowed

- Rent or mortgage payments

- Utilities

- Transportation

- Groceries

- Debt payments

- Emergencies

Not allowed

- Eating out

- Clothes

- Decor

- Entertainment

- Online shopping

How long should you do the no-spend challenge?

The no-spend challenge helps participants stop overspending at any time. How long you choose to do the no-spend challenge depends on your situation and goals. Are you a chronic overspender? Start small and work up to a longer time frame. By not spending money a day at a time, you’ll slowly build up your self-discipline and motivation. Then try not to spend for one week, one month, or even longer.

Here are the most popular lengths of time for the no-spend challenge.

Weekend

Avoid spending money over the weekend when temptations are highest. It will require creativity to stay entertained while not spending. Trade expensive activities for free alternatives, like a free picnic versus eating out. After the weekend, ask yourself how difficult it was to cut back on two days of spending. This quick test will reveal a lot about your money habits.

Week

Go one week without unnecessary expenses. Look at your daily habits. Notice which expenses were hard to go without, like a daily coffee or ordering lunch. Now determine how much money you saved over the course of the week. Ask yourself if it was worth saving and how these funds could be better spent.

Month

The most common length of time for the no-spend challenge is one month. Spend a month practicing frugality, discipline, and budgeting. In fact, one month is enough time to establish life-long habits, including a change to your financial behavior. Need more motivation? Think of how much money you could save in a month versus a week!

Year

If you’ve successfully completed a few months of the no-spend challenge, why not keep it going? Don’t be discouraged. One year of not spending money is challenging for even the most disciplined participants. To keep yourself motivated, set a large financial goal at the end, like allocating extra funds to save up an emergency fund.

Why choose the no-spend challenge?

There are several benefits to pausing your spending habits. Think of it like fasting. You’ll realize how dependent you were before you started. But in this case, your dependency was on spending money.

The no-spend challenge is helpful for those who want to evaluate or change their behaviors. The challenge will reveal:

- If you’re an impulsive spender.

- How much money you waste on unnecessary expenses.

With further digging, it can also help you determine why you feel the need to spend money on unnecessary things. Do you tie value to buying new or expensive items? Are you relying on retail therapy instead of addressing issues in other areas of your life? Participants of the no-spend challenge often realize that their spending habits signal key traits about their financial behavior. All thanks to a much-needed pause.

Is the no-spend challenge right for you?

Pros

- Stop overspending. The goal of the no-spend challenge is to reduce overspending. Take stock of your negative spending habits. Work to change these habits over time.

- Start saving. By not spending, you’ll save more money. Allocate the new savings to an emergency fund, paying off debt, or saving for a financial goal.

- Create a budget. Cut “wants” out of your budget during the challenge. Use this time to prioritize “needs,” debts, and savings.

Cons

- Requires discipline. Cutting off all spending is hard. Overspenders will find it hard to stay disciplined and motivated during the challenge.

How can you hack the no-spend challenge?

No. 1: Freeze your cards … literally

Need help sticking to the no-spend challenge? It might be time to freeze your credit cards — literally.

The general idea is to place credit cards in a freezer-safe dish or freezer bag, fill it with water until the cards are submerged, and then hide it in the back of the freezer. To access the credit cards, you’ll need to let them thaw — effectively stopping impulse purchases.

No. 2: Set an end goal

You’ll be more successful and less likely to quit the no-spend challenge when you have an end goal. Define your motivation and set a financial goal. Visualize the end goal during the challenge to stay motivated. Here are a few goals:

- To reduce spending

- To save money

- To make a lifestyle change

- To use extra money to pay off debt

- To create a budget that works for you

No. 3: Adjust the challenge

How you put the no-spend challenge into practice is your choice. You don’t have to stick to the rules. So why not create your own?

Some people choose to stop all spending, while others budget a few treats. For example, limiting an entertainment budget, but keeping a subscription service. The goal is to change your spending habits, but that doesn’t mean you can’t budget small joys. Give yourself something to look forward to if you follow the challenge for longer than a month.

No. 4: Create a competition

Enlist your friends and family to join in on the no-spend challenge. A friendly competition will help keep you motivated and accountable. Add a low-stakes bet to the challenge. Whoever saves the most money from reduced spending by the end of the challenge is the winner.

Bottom line

Refresh your money habits with the no-spend challenge. It’s a strategic way to curb spending and focus on saving — for however long you choose.