How to Survive and Budget When You’re Making Minimum Wage

Finding extra money to put aside isn’t easy when you’re working a minimum wage job, but that doesn’t mean you can’t do it.

If you’re having a tough time living off minimum wage, it’s not surprising.

The current federal minimum wage is $7.25 per hour. But just because this is the minimum wage, doesn’t necessarily mean that it’s a living wage.

Adjusting for inflation, today’s federal minimum wage is worth 30% less than it was in 2009 — which is the last time the United States saw a federal wage hike.

The federal minimum wage has not risen with inflation, the cost of rent, child care, food, education, health insurance, and other cost-of-living expenses, so how are American workers getting by?

Stretching the American dollar

Currently, 29 states and the District of Columbia offer minimum hourly wages that are higher than the federal minimum wage. However, that means the federal rate applies in 19 other states. If you are thinking that math doesn’t add up (there are 50 states, right?), you are correct. Two states — Georgia and Wyoming — have their minimum wage set at $5.15 per hour for businesses that meet certain criteria.

How do state minimum wage laws compare to the federal minimum wage of $7.25?

| State | Basic Minimum Rate (per hour) |

| Alabama | No state minimum wage law. |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11.00 |

| California | $16.00 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| District of Columbia | $17.50 |

| Florida | $12.00 |

| Georgia | $5.15 |

| Hawaii | $14.00 |

| Idaho | $7.25 |

| Illinois | $14.00 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | No state minimum wage law. |

| Maine | $14.15 |

| Maryland | $15.00 |

| Massachusetts | $15.00 |

| Michigan | $10.33 |

| Minnesota | Large employer (enterprise with annual revenues ≥ $500,000): $10.85

Small employer (enterprise with annual revenues < $500,000): $8.85 |

| Mississippi | No state minimum wage law. |

| Missouri | $12.30 |

| Montana | Businesses with gross annual sales of more than $110,000: $10.30

Businesses not covered by the Fair Labor Standards Act with gross annual sales ≤ $110,000: $4.00 |

| Nebraska | $12.00 |

| Nevada | $12.00 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12.00 |

| New York | $15.00;

*$16.00 for New York City, Nassau County, Suffolk County, & Westchester County |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | Employers with annual gross receipts ≥ $385,000: $10.45

Employers with annual gross receipts < $385,000: $7.25 |

| Oklahoma | Employers with 10 or more full time employees at any one location or employers with annual gross sales > $100,000 irrespective of number of full time employees: $7.25

All other employers: $2.00 |

| Oregon | $14.70 (standard state rate);

$15.95 (Portland Metro Area); $13.70 (Non-Urban counties) |

| Pennsylvania | $7.25 |

| Rhode Island | $14.00 |

| South Carolina | No state minimum wage law. |

| South Dakota | $11.20 |

| Tennessee | No state minimum wage law. |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12.00 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $5.15 |

Source: https://www.dol.gov/agencies/whd/minimum-wage/state, updated July 1, 2024

If you’re one of the 1.02 million hourly workers in America who rely on federal minimum wages — or even less — to get by, you aren’t alone, but odds are good that your finances are pretty tight and saving money isn’t easy.

“You have to be smart to be [both] poor and a very good money manager to handle such a small amount of money well,” says Mike Sullivan, a personal finance consultant.

Let’s be real, when it comes to balancing minimum wage earnings with life’s priorities, it may seem like there are only so many ways to stretch a dollar. Hopefully, the following five tips can help.

Tip No. 1: Nail down your income and expenses

The first step to budgeting is knowing how much money is coming in and how much is going out.

Carla Dearing, CEO of Velo Group, says many of us have no idea how much our expenses are each month. “When you know where your money goes, you are in control and can be thoughtful about aligning spending with priorities,” she says.

It can be easy for anyone to miss how much they’re spending if they aren’t paying close attention. Dearing suggests using money tracking services like Mint or Quicken to track your monthly expenses and create a budget.

Once you’ve identified where your money is going, it’s time to start figuring out where you can make some cuts, if possible. Michael Outar, founder of personal finance and development blog Savebly, recommends practicing delayed gratification by cutting down on unnecessary expenses.

“Cut down on wants now, so you can pay off your debts/expenses and save money for a rainy day,” Outar says.

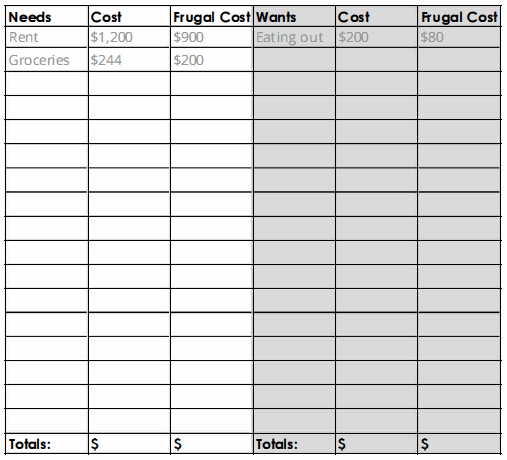

The worksheet below, which you can download here, can help you track the difference between the “wants” that Outar mentions and your needs.

Tip No. 2: Find alternatives to mainstream services

It may be necessary for minimum wage workers to find low-cost alternatives for mainstream services and needs, such as food, housing, transportation, banking, and entertainment, just to make ends meet. Here are a few ideas to help get you started:

Transportation

Cars come with a lot of financial obligations: monthly payments (if you don’t own your vehicle in full), gas, insurance, registration, and ongoing maintenance. Depending on where you live, you may even have additional parking or registration fees to worry about.

If you don’t need a car to meet your basic responsibilities -- like getting to work or taking your kids to school -- and you can safely walk, bike, or use public transportation, you may want to consider ditching your ride.

“You don’t want to have a car because you probably can’t afford the insurance or repairs if you’re making minimum wage,” Sullivan says. “It’s going to be an albatross.”

Food and groceries

Food insecurity is common in the United States. About 18 million American households experienced food insecurity in 2023.

Previously known as food stamps, the Supplemental Nutrition Assistance Program (SNAP) can help subsidize the cost of food. Your state agency will determine if you are eligible to receive SNAP benefits. For an eligible household of three, SNAP can provide a maximum monthly allotment of $768.

Food pantries, which distribute food and services to the community, are another alternative resource. Additionally, when you do go to the grocery store, it’s worth preparing a list beforehand. Buying frozen foods and items in bulk can also help.

Housing and location

Finding affordable housing, especially in large metropolitan areas where housing costs are particularly high, can be challenging.

In the 2024 Mid-Year Cost of Living Index, New York City, San Francisco, Boston, Washington, D.C., and Seattle were the five most expensive urban areas.

If you are a single person living alone or in a position to take on a roommate, you may have an opportunity to drastically cut your monthly expenses by splitting the costs associated with rent and utilities. Roommates can also help reduce everyday costs on food and basic household items like cleaning supplies and toilet paper.

Whether or not the above applies to you, it may be worth looking into subsidized housing through the U.S. Department of Housing and Urban Development’s Section 8 Rental Certificate Program. Another option for minimum wage workers is to consider moving to areas that have more job opportunities and better social services programs.

Banking

The 2021 FDIC National Survey of Unbanked and Underbanked Households reported that 4.5% of U.S. households didn’t have a checking or savings account. Not having enough money to meet the minimum balance requirements was the most common reason cited for not having a bank account.

“One overdraft fee of $35 can be damaging,” Sullivan says.

Money orders and check cashing were the most common alternative financial services used by the unbanked population, which mostly consist of low-income households, the survey says.

Tip No. 3: Schedule your bills

A little planning for the future can go a long way, even when you’re living off of minimum wage.

Scheduling basic expenses around paydays can help ease cash flow and minimize potential cash crunches. According to our article on living paycheck to paycheck, creating your budget around this practice may also be helpful for your cash flow.

By separating your heavy-duty expenses into different paycheck cycles, it can keep you from being completely wiped out while you wait for your next payday. You may have to change the due dates for certain larger bills to accommodate this method.

Tip No. 4: Save small

How are you supposed to even think about saving when you’re barely getting by? The less you earn, the more important it is to have savings. It’s an unfair contradiction.

“If you are earning a low wage, don’t let it discourage you from saving,” says Money Elevation Coach Roslyn Lash. “Temporarily ignore the suggestions about saving a minimum of 20%. It is more important that you save something, and no amount is too small.”

When Lash was in college, she received a $7.50 stipend per week. She saved 50 cents per week.

“It wasn’t a lot of money, nor was it an uncomfortable amount to set aside, but those cents accumulated and it helped to develop a habit of saving,” Lash says. “It gave me a sense of pride.”

It may seem impossible, but saving slowly toward an emergency fund can help you in the long run.

Tip No. 5: Focus on increasing your wages

Finding a job with higher wages isn’t always simple — especially when you’re working a full-time minimum wage job with inflexible hours, which can make your job search even harder. However, it’s worth looking into all your possible options, including part-time jobs to increase your income.

“Saving money is great, but when you are making minimum wage there are only so many ways to cut costs,” Outar says. “You need to find ways to make more money — ask for a raise at your job, get a new job, or take on some gigs for more income.”

Carla Dearing is the CEO of Velo Group. Previously, Carla held senior executive positions at the University of Louisville, Community Foundations of America and Investors Capital Services. Earlier, she worked at Morgan Stanley and American National Bank & Trust Company. She holds an MBA from The University of Chicago Booth School of Business and a BA from the University of Michigan, Phi Beta Kappa.

Roslyn Lash, the Money Elevation Coach, is an accredited financial counselor, real estate investor, and author of The 7 Fruits of Budgeting. She works virtually with single women helping them to gain clarity around their finances, reduce debt, and increase their net worth so that they can live a more abundant life. Her advice has been featured in national publications, including USA Today, Forbes, TIME, Huffington Post, and Los Angeles Times.

Michael Outar is the founder of Savebly, a blog about personal finance and personal development. He took control of his money and paid off $24,000 in student loans before 24 years old. Michael believes that if you make simple lifestyle changes you can drastically improve your financial life and he wants to show you how. You can follow him @savebly.

Mike Sullivan is a personal finance consultant. He has more than 25 years of experience educating consumers about a wide range of budgeting, credit, debt and saving issues.

Please note the below article contains links to external sites outside of OppU and Opportunity Financial, LLC. These sources, while vetted, are not affiliated with OppU. If you click on any of the links you will be sent to an external site with different terms and conditions that may differ from OppU’s policies. We recommend you do your own research before engaging in any products or services listed below. OppU is not a subject matter expert, nor does it assume responsibility if you decide to engage with any of these products or services.