Study: More Than One in Four Americans Say Their Debt is Unmanageable

Money can’t buy happiness, or so the saying goes. Still, there’s only so much truth to that saying. With some households experiencing financial instability since the beginning of the pandemic, we wondered how Americans felt about their financial situations in 2022.

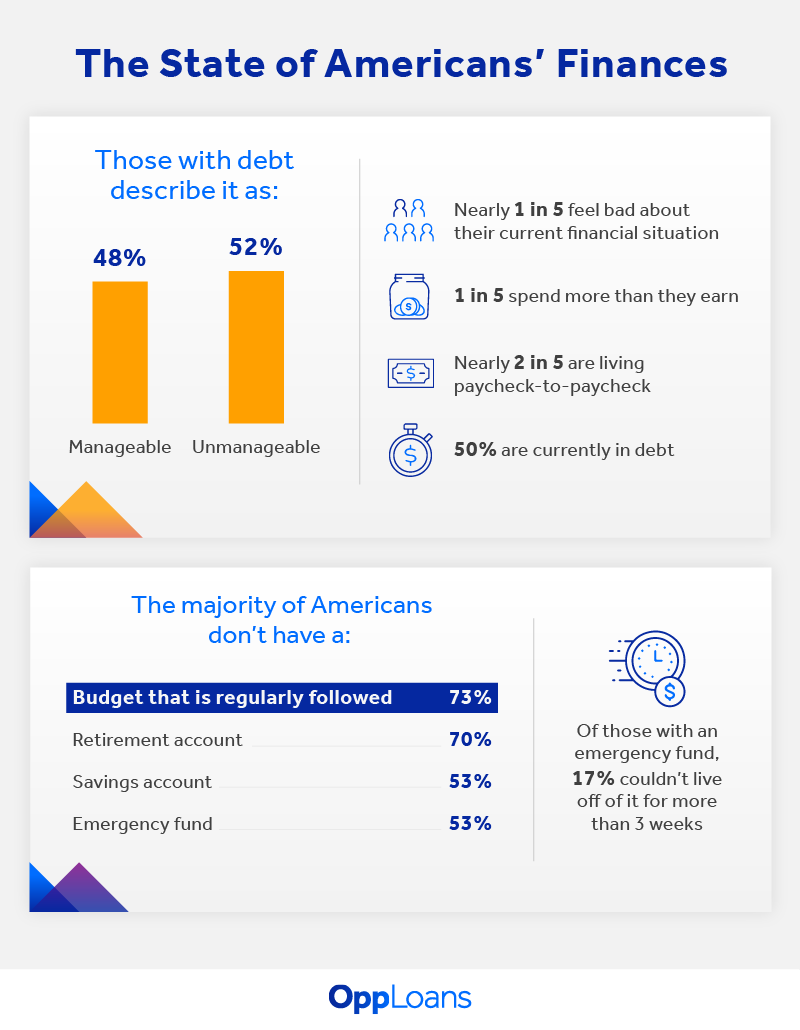

To learn more about Americans’ financial situations, we surveyed nearly 1,100 Americans. Respondents had mixed feelings about where they stood financially, with nearly one in five feeling bad or very bad about their circumstances.

Key takeaways

- Half of the respondents were in debt, and 52% of those in debt said their debt was not manageable.

- Just over 1 in 3 respondents frequently experienced stress or anxiety about their finances since the COVID-19 pandemic started.

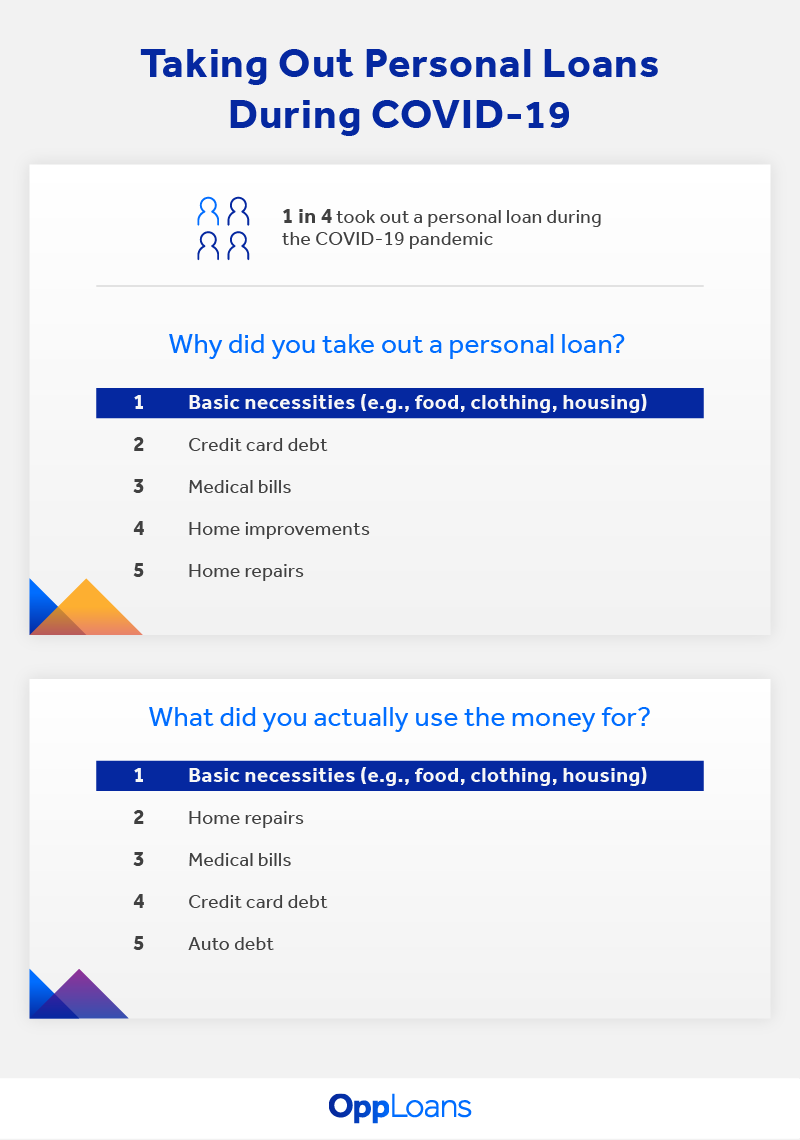

- 1 in 4 took out a personal loan during the COVID-19 pandemic, most often to cover basic necessities such as food, clothing, housing, and credit card debt.

What did Americans’ financial situations look like?

Americans’ financial health is often measured by benchmarks such as debt, savings, spending habits, and the ability to pay their monthly bills. Our respondents reported having difficulty with many of these things.

Half said they were in debt, and nearly half said they couldn’t pay their bills on time. Almost 2 in 5 lived paycheck to paycheck, and 1 in 5 said they spent more than what they earned.

Budgeting is widely considered an important aspect of personal finance, but 1 in 10 said they didn’t have a budget at all.

Fewer than half (47%) said they had a savings account or emergency fund. Of those who did, nearly 1 in 5 said they could live off it for three weeks at the most.

How COVID-19 impacted Americans’ financial situations

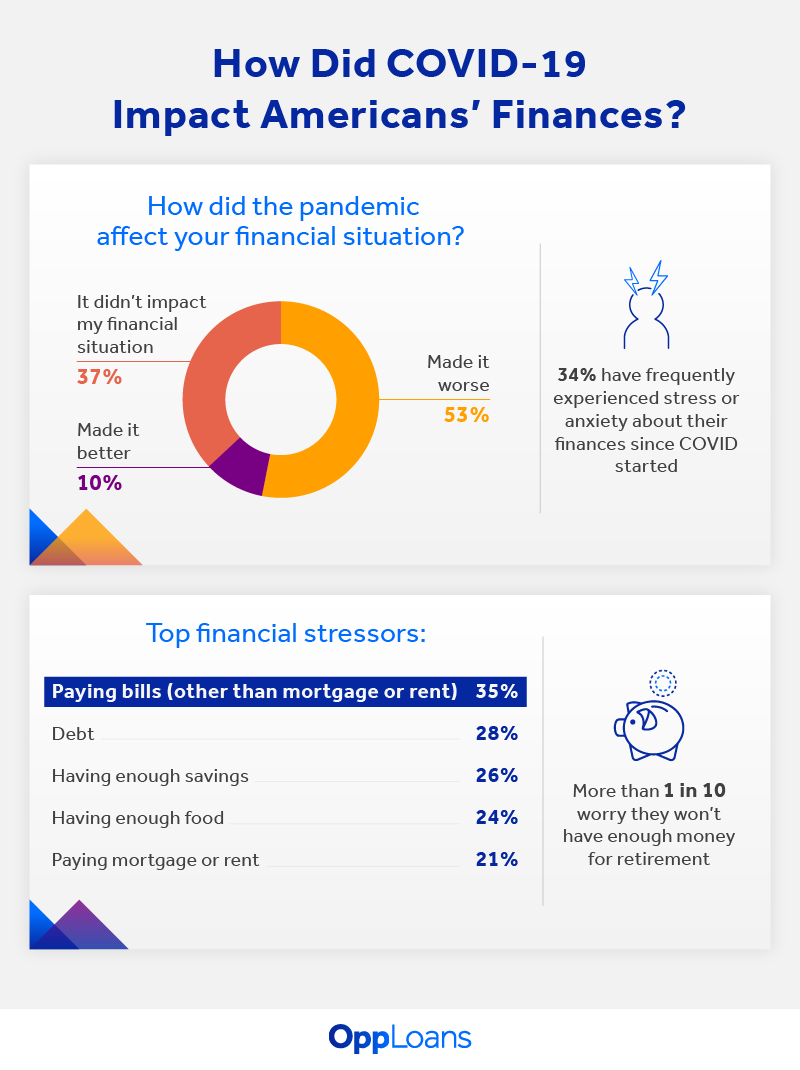

The COVID-19 pandemic threw the American economy into chaos, with numerous businesses closing. In April 2020, the unemployment rate reached a level not seen since the 1930s. Near the end of 2021, 10 million households were behind on rent despite three rounds of stimulus checks.

More than half the people we surveyed said the pandemic worsened their financial situation. The biggest reason? Employment - more than 1 in 5 were working fewer hours and 15% lost their jobs. Others cited their illness (17%), and 15% said their credit scores decreased.

Despite the pandemic, many respondents said they had a fair, good, or very good credit score as of 2022 (25%, 22%, and 20%, respectively), and most said COVID-19 didn’t negatively affect them. However, over 1 in 4 respondents who made less than $35,000 per year said the pandemic caused their credit score to decrease.

Debt during COVID-19

Another aspect of Americans’ household finances affected by COVID-19 was their debt. In fact, most types of debt increased during the pandemic including student loan debt and credit card debt. Credit card debt was the biggest source of new debt: 3 in 5 respondents said they incurred new credit card debt.

1 in 4 said they incurred new debt from mortgages, and 1 in 5 from home equity/lines of credit. Of new personal loan debt acquired during the pandemic, 40% said they acquired $5,000 or more.

The biggest financial stressors

One result of financial difficulty was stress. Just over 1 in 3 respondents said they frequently experienced stress or anxiety related to their finances since the start of COVID-19, with the most common stressor being paying bills other than mortgage or rent (cited by 35%). Debt was identified as a source of stress by 28% and 26% were stressed about not having enough savings.

Other stressors included basics like having enough food and paying mortgage or rent. Financial anxieties also reached as far as retirement, with more than 1 in 10 saying they worried they wouldn’t have enough to retire.

Personal loans before and during the pandemic

With so many people seeing their source of income interrupted, it was no surprise that roughly 1 in 4 people (26%) took out a personal loan during the pandemic compared to 20% who took out a personal loan any time prior to the pandemic. Those who said they were negatively impacted by COVID-19 were more likely to take out a personal loan, with 40% borrowing $5,000 or more in 2020 and 2021.

Those who took out loans mainly did so to buy necessities or pay credit card debt (the same reasons cited prior to the pandemic). They were fairly optimistic about their ability to repay those loans, with nearly 1 in 5 having already paid them off and 60% saying they expected to do so in less than five years.

Who took out these personal loans? Most of them were taken out by respondents who made between $75,000 to $120,000 per year but were in debt, and by respondents who had taken out loans prior to the pandemic.

Looking ahead

People still plan to incur debt: most of it from credit cards and personal loans. In fact, 3 in 10 people said they plan to take out a personal loan in the future. Furthermore, many of the people who took out a personal loan before or during the pandemic planned to take one out in the future.

However, even with the pandemic entering its third year at the time of the survey, many respondents remained optimistic. More than 2 in 5 expected their finances to improve that year.

Methodology: OppLoans commissioned an online survey through SurveyMonkey to interview 1,015 Americans about their current financial situations. The survey began on January 14, 2022; 50% of respondents were male and 50% were female; 26% were 18-29, 25% were 30-44, 27% were 45-60, and 22% were older than 60. The following census regions were equally represented: Northeast, Midwest, South, and West.

Please note the below article contains links to external sites outside of OppU and Opportunity Financial, LLC. These sources, while vetted, are not affiliated with OppU. If you click on any of the links you will be sent to an external site with different terms and conditions that may differ from OppU’s policies. We recommend you do your own research before engaging in any products or services listed below. OppU is not a subject matter expert, nor does it assume responsibility if you decide to engage with any of these products or services.