Budget for a Baby (Without Going Into Debt)

Dirty diapers, mysterious rashes, and late-night crying fits.

Being a new parent is tough. So much gets thrown at you, and far-off financial considerations can take a back seat to the here and now.

But welcoming a baby into the world has big (and immediate) implications for your wallet: How will you budget for major expenses when paying for an unlimited supply of diapers, formula, and wipes? How will you finance an emergency? And what about paying for child care?

Here’s some expert advice about what to expect financially — when you’re expecting.

How much do babies cost?

When you’re a first-time parent, it’s easy to become overwhelmed with budgeting decisions. From diapers to daycare, expenses can seem endless when it comes to raising a new human. It’s also tempting to buy your little one the cutest onesies and a top-of-the-line bassinet.

“People are excited and can overspend on baby clothes and baby furniture,” says Barbara O’Neill, Ph.D., the owner and CEO of Money Talk and a certified financial planner. “It’s adding a lot of new expenses to your cash flow that you haven’t had previously.”

New parents spend about $1,700 for diapers and wipes in the first year. But the growing costs don’t stop there.

The average cost for the first year of a child’s life is $13,186. And the average cost for raising a child until the age of 17 clocks in at more than $310,605 — which doesn’t factor in money set aside for college savings.

On top of all this, baby-related expenses can be unpredictable and start before newborns even arrive. Not all pregnancies are ideally timed, and expenses such as extra medical bills and maternity clothes can add up quickly.

With all these costs in mind, below are five tips to help expectant parents financially prepare for their newest family member.

No. 1: Revisit financial goals

Logan Allec, CPA and owner of Money Done Right

Having a baby signals a huge shift in the trajectory of your life. As a new parent, now is the time to readjust your financial goals.

Sit down and create a realistic strategy towards achieving them. After you take a second look at your financial goals, maintenance is key. Schedule a monthly meeting to go over your finances. This will help you ensure that your family is staying on the right track financially.

No. 2: Create a budget to determine where you can save

When you’re having a child, creating a budget can be an important first step to help prepare for the big rush of new expenses coming your way, and it’s important to do so before the baby arrives instead of after.

Looking under the hood at the past 3 to 6 months of your spending can reveal opportunities to trim expenses and save for your baby budget, says Brooke Cassady, a certified financial planner. She recommends that expectant parents save enough money for the cost of delivery and postpartum expenses, such as loss of income during parental leave in addition to co-pays and hospital bills.

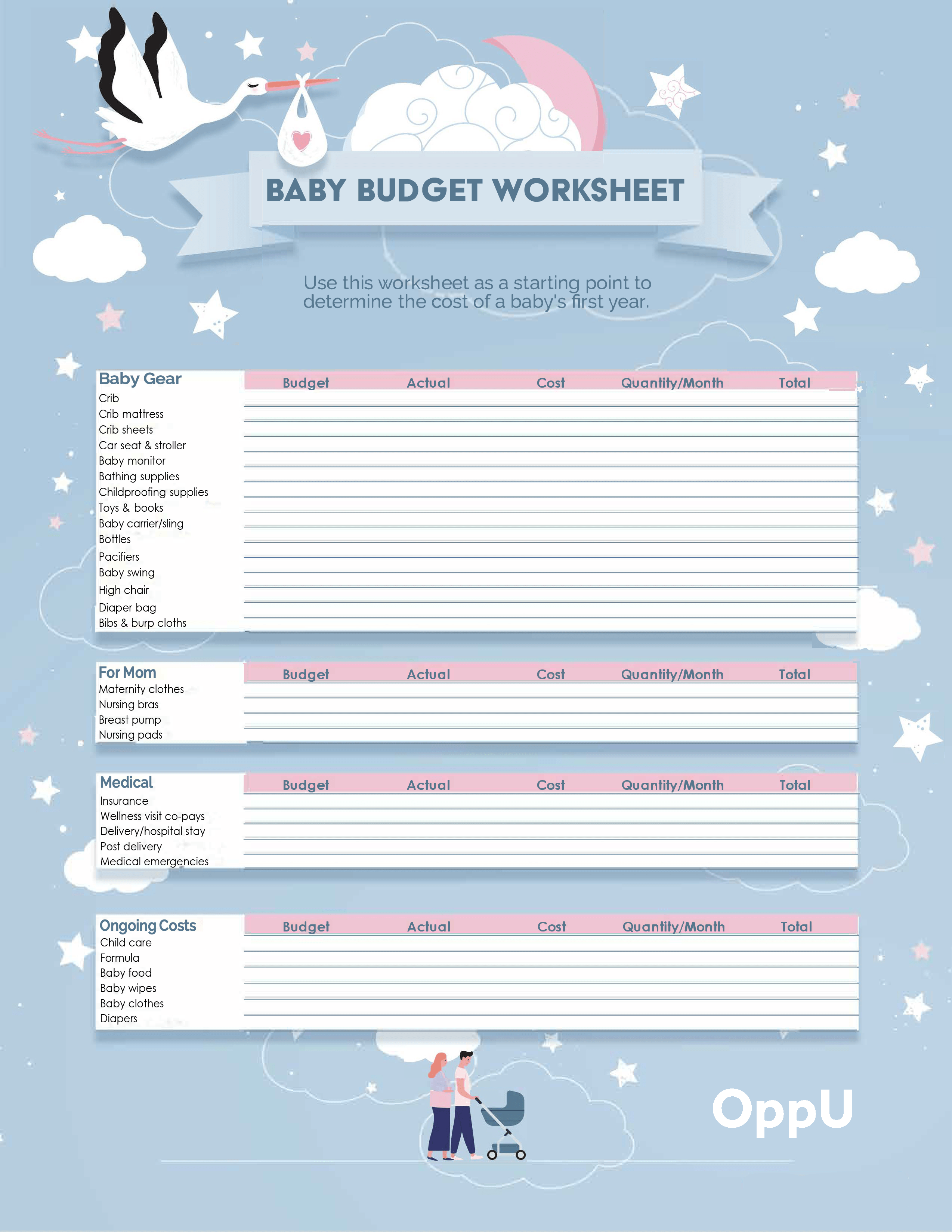

Not sure how much money you actually need to save for your impending arrival? We’ve created a tool to help you map out your expenses:

No. 3: Don’t rush expensive purchases

Logan Allec, CPA and owner of Money Done Right

Don’t feel rushed to buy a new car or put a down payment on a home. Combined with the cost of raising a newborn, these purchases can put you in a financial hole. Think through these purchases and plan accordingly.

Don’t be afraid to buy secondhand items, as well. Your baby will soon grow out of their clothes and toys. As a result, don’t try to keep up with trends. The only item you should prioritize buying new is a car seat.

No. 4: Understand potential out-of-pocket health care costs

Lara Hourquebie and her husband started saving immediately when they found out she was pregnant with their first child. At the time, the Washington, D.C.-area couple were still paying off expenses from their wedding and Hourquebie’s husband was underemployed. “We had no savings and we knew our expenses would increase,” Hourquebie says. “We saved every dime my entire pregnancy.”

For Hourquebie, navigating her health insurance plan to figure out how much she should budget to deliver her child was stressful. After birth, she and her husband worked with the hospital to set up an interest-free payment plan to slowly pay down the cost.

“We are still paying off his birth three years later,” Hourquebie says. “We didn’t have the ability to throw out $5,000.”

Hourquebie isn’t alone in having a four-figure bill to pay off after giving birth. The average out-of-pocket health care bill for childbirth with health insurance is $2,854. Cost is also dependent on the type of birth (vaginal or cesarean).

Unexpected costs

Because pregnancies can be unpredictable, Cassady says, having extra money set aside in an emergency fund for medical issues for mom or baby is a good idea.

Meredith Huck of Milford, Connecticut, incurred a $25,000 procedure her son needed nine months after he was born. Insurance covered part of the treatment and they used their savings to pay the $12,000 deductible.

“We didn’t know he would be sick and we didn’t expect to hit our deductible in June of a calendar year,” Huck says.

Don’t forget about insurance premiums

One other thing to note: Adding a new family member to an insurance policy can also impact the rate of your monthly premium and overall deductible. Start investigating your insurance options as soon as possible to get a handle on how this will impact your overall budget.

No. 5: Find creative ways to reduce child care costs

The Hourquebie family budget revolves around child care. About 25% of the family’s salary goes towards paying for their son’s full-time day care.

“Child care is the foundation for our budget,” Hourquebie says. “We work all of our other expenses around that.”

To alleviate costs of child care, Robert Gariano, a financial consultant who specializes in helping millennials and new families budget, suggests relying on family members that may be retired or nearby to help care for your new baby.

“If you can find a way to facilitate a family member or partner up with friends for a joint nanny-share during the day, it can really cut child care costs,” Gariano says.

No. 6. Identify places to skimp

Little ones grow quickly. Huck rarely buys new things for her children and has found lots of ways to save money. She found baby furniture like a crib on Facebook Marketplace and has received baby gear from family hand-me-downs and baby showers.

Buying the bare necessities of baby gear like a car seat, crib, diaper bag, changing table, baby monitor, and stroller can add up. It’s important to think critically about baby costs so you don’t go into debt from unnecessary purchases.

“Children tend to outgrow clothing quickly, so think of how long everything you’re purchasing will last,” O’Neill says.

While it is important to buy baby basics with up-to-date safety standards, purchasing from consignment stores and second-hand shops can decrease the impact on your wallet compared to retail prices.

“You don’t need the best one out there, just make sure it’s quality, so it won’t fall apart,” Gariano says. “Do what makes sense for your budget.”

Another area for potential savings is to make your own baby food. All you need is a food processor. Cassady found making her own baby food was more cost-effective than buying individual jars at the store. She’d make baby food in bulk and freeze it.

No. 7: Use all your resources

Be sure to take advantage of resources that are already at your disposal. Here are a few to research as soon as possible:

Community and government programs

If your family qualifies, reach out to community organizations that can help secure monetary aid and baby-related resources. Churches, co-op extensions, hospitals, and other community aid organizations that focus on life-skills planning can also provide information about parenting and child development.

Governmental programs like the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) provide nutrient-rich food and health care referrals for eligible low-income women and to infants up to age five. The program also supports pregnant women.

The Supplemental Nutrition Assistance Program (SNAP) is a similar governmental aid program that assists families to purchase healthy food.

Potential tax breaks

After giving birth, take advantage of tax breaks that are available. You’ll also need to adjust your withholdings and file a new W-4 with your employer.

“This will put more money in your paycheck or give you a big tax refund,” O’Neill says.

Additionally, ask your employer if they offer a Dependent Care Flexible Spending Account, which allows parents to put away a set amount of pretax money for qualifying child care expenses.

Insurance

Make sure to find out what needs your insurance will cover. Breastfeeding supplies and support like breast pumps and lactation counseling are often supported by insurance plans.

No. 8: Plan for retirement

Logan Allec, CPA and owner of Money Done Right

With a new baby, retirement may be the furthest thing from your mind, but planning for retirement will protect your child from the possibility of having to support you in the future. Take advantage of any employee-backing 401(k) account. Set up autopay, so you never have to worry about growing the account.

Bottom Line

Personal finance might be low on your list of priorities when you have a new child, but it shouldn’t be. So use these tips to bring home a bundle of joy — not money stress.

Brooke Cassady, a certified financial planner with a master of arts in applied economics, provides comprehensive financial life planning and financial counseling services to individuals and families. She currently holds positions as both practitioner and in academia.

Robert Gariano is a certified financial planner who focuses on helping older millennials and new parents navigate through personal financial matters, such as cash flow, home purchasing, educational funding, life insurance, as well as tax and estate planning. Rob joined Gariano Wealth Management in 2014 after previously holding positions at Morgan Stanley and Lord Abbett, where he earned the Series 7 and Series 66 registrations as well as his life, health, and accident insurance license.

Dr. Barbara O’Neill, a certified financial planner and accredited financial counselor, is the owner/CEO of Money Talk: Financial Planning Seminars and Publications where she writes, speaks, and reviews content about personal finance. A distinguished professor emeritus at Rutgers University, after 41 years of service as a Rutgers Cooperative Extension educator and personal finance specialist, she has written more than 160 articles for academic publications and received more than 35 national awards and $1.2 million in grants to support her financial education programs and research. O’Neill is a past president of the Association for Financial Counseling and Planning Education (AFCPE), a recipient of the AFCPE Distinguished Fellow Award, and a Next Gen personal finance fellow. Tweet her @moneytalk1.

Logan Allec is a CPA, personal finance expert, and owner of the website Money Done Right. After spending his twenties grinding it out in the corporate world and paying off more than $35,000 in student loans, he dropped everything and launched Money Done Right in 2017. His mission is to help everybody — from college students to retirees — make, save, and invest more money. He currently resides in the Los Angeles area with his wife Caroline and son Hunter.