The 52-Week Savings Challenge: Everything You Need to Know to Start Saving Now

Are you ready to start saving but don’t know where to begin? Try the 52-week savings challenge; a simple way to jumpstart your financial goals. It leverages financial psychology to get you in the habit of saving and building a nest egg. If you stick with it, you could pocket $1,378 by the end of the year!

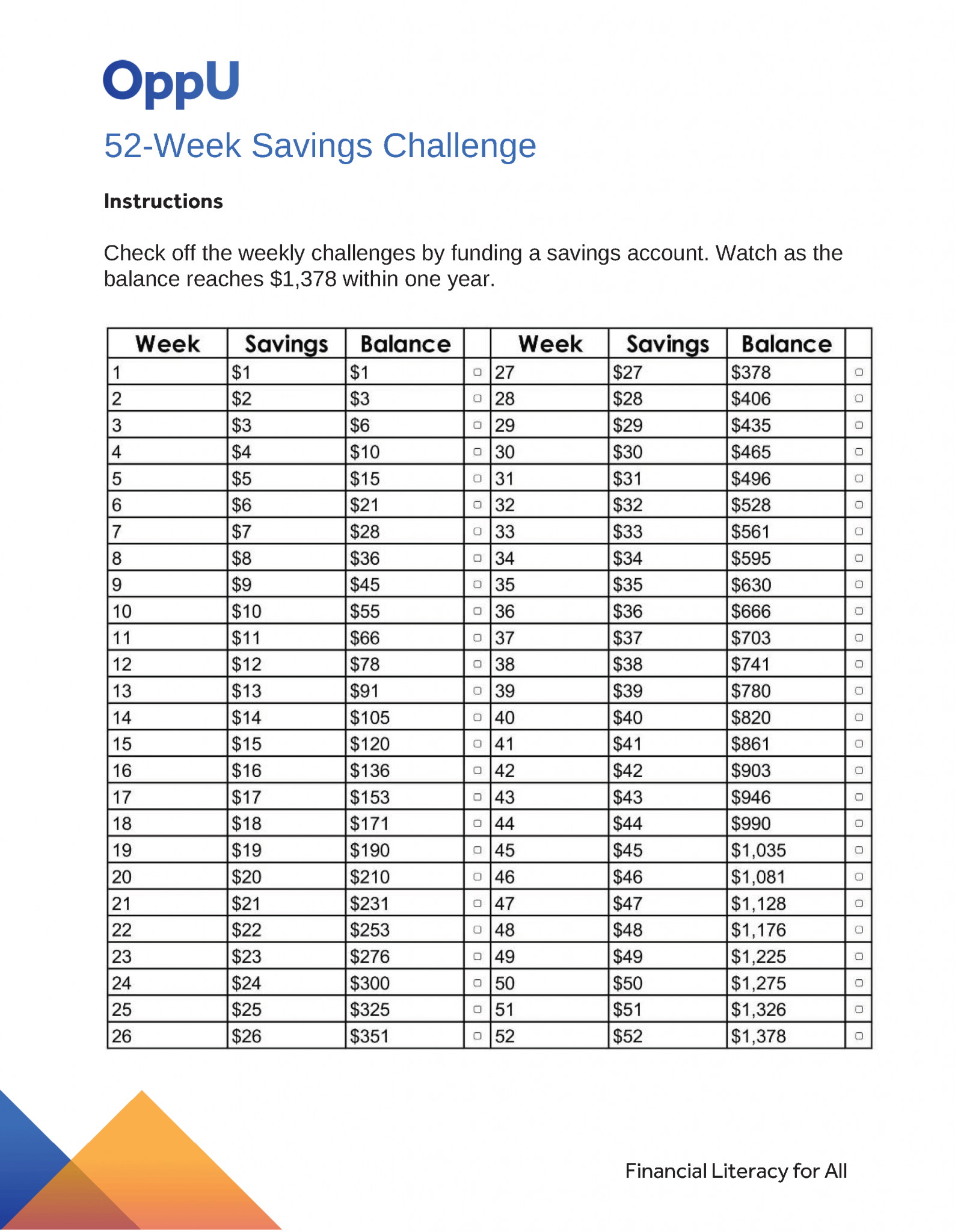

Take control of your financial future. Give the 52-week savings challenge a try and download our worksheet to stay on track.

DOWNLOAD THE 52-WEEK SAVINGS CHALLENGE WORKSHEET

What is the 52-week savings challenge?

The 52-week challenge is a strategic and motivational savings plan. Participants commit to saving a certain amount each week, and while the amount starts small, it grows larger over time. At the end of the challenge, the total amount saved will reach nearly $1,400.

How does the 52-week savings challenge work?

For one year or 52 weeks, participants contribute money into a savings account each week. The goal is to save $1,378 within one year.

Match the number of the week to the amount saved:

Contribute $1 in week one, $2 in week two, $3 in week three and so on. Deposit money at an increasing rate each week until you reach $52 in week 52.

Remember, small wins accumulate into a large reward. Keep up the work and watch your savings account grow.

When is the best time to start the 52-week savings challenge?

New Year’s is an ideal time to take stock of your finances and start the 52-week savings challenge, but that’s only a suggestion.

You can work toward your financial goals at any time. It is recommended to try the challenge at the start of a new month or week.

Is the 52-week savings challenge a good fit?

Pros

- Prioritizes savings. The point of the 52-week challenge is to kickstart a savings goal. Motivation to save will increase as your balance grows.

- Adaptable to fit any budget. Start small by only saving a few dollars each week. The deposits won’t break the bank, so it’s manageable and adaptable to fit any budget.

- Improves self-discipline. It’s easy to justify small everyday expenses, like coffee or a manicure. This challenge uses the same logic, focusing on small amounts, with a gradual increase in deposits. Before you know it, you’ll treat saving like your spending habits.

Cons

- End-of-year is challenging. The challenge encourages saving the largest amount towards the end, which may coincide with the holidays, which are typically an expensive time of year.

- Missed opportunity. If saving a few dollars each week is doable, then you are missing out on savings and interest earned. It is recommended to deposit more than the suggested amount.

How can you hack the 52-week savings challenge?

No. 1: Open a savings account

Open a high-yield savings account. Why? A high-yield account will accumulate more interest over time. To lessen the temptation to spend, it is advisable to keep it separate from your checking account.

No. 2: Adjust the challenge

Who says you have to stick to the original rules? There are several ways to approach the challenge. Here’s how to adjust it to fit your budget:

Save more money

If you can afford to deposit more, do it. Don’t cut your savings short; view the challenge as a suggested minimum.

Reverse the challenge

Tackle the challenge out of order. For instance, reverse it and check off the larger deposits first. This will make the final challenge weeks much easier.

Keep up the momentum

Hit your savings goal in 52 weeks? Great, keep up the momentum. See if you can save for another year, with or without the challenge.

No. 3: Automate it

Set up an automatic savings plan. If your workplace offers direct deposit, ask for a portion to automatically deposit in your savings account to avoid the temptation of spending your full paycheck. Automating it will ensure you meet your savings goal.

No. 4: Create motivation

Focus on an end goal; whether that’s saving for a vacation or starting an emergency fund. Working towards a goal will keep you motivated throughout the year. Take the time to celebrate reaching milestones. These little wins can boost motivation to keep going.

No. 5: Make it a competition

Turn the challenge into a friendly competition. Enlist your friends and family to take the savings challenge. Having an accountability partner will act as motivation to keep you on track.

Bottom line

Kick off your financial goals with the 52-week savings challenge. It’s a simple way to save nearly $1,400 in one year.