How to Read a Pay Stub

It’s payday!

Your check comes and with it your pay stub. The pay stub is less exciting than the check; It contains a whole bunch of information, but really all you care about is that sweet deposit to your bank account.

But what about those other numbers? What are they? Do they matter?

To help you read your pay stub, we detailed all of the different sections you’ll find on yours. Take a look!

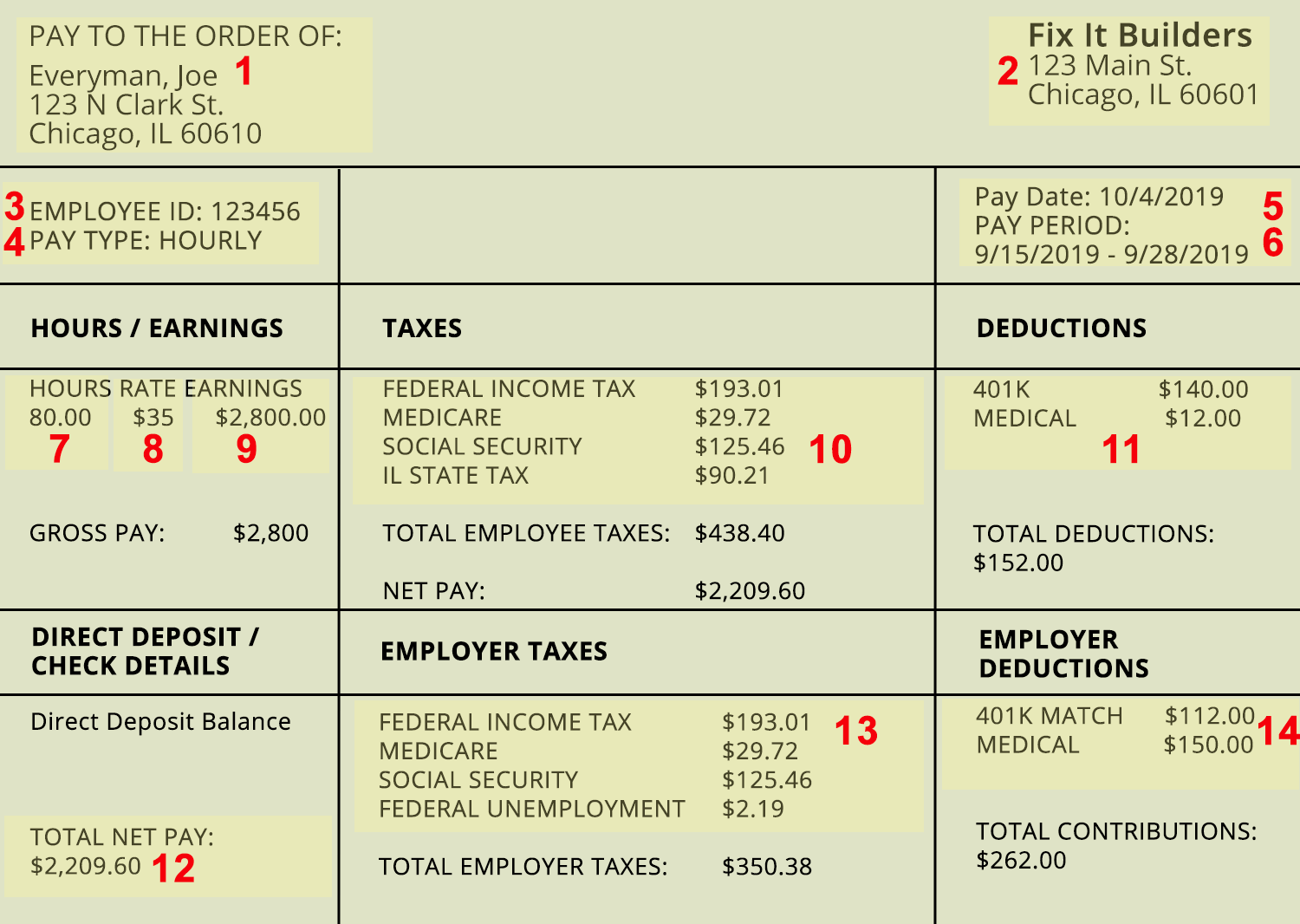

How to read a pay stub

1. Employee name and address

The full name and address of the person receiving payment.

2. Company name and address

The employer’s name and address. Sometimes this section will also contain the employer’s phone number.

3. Identifying information

Some companies include an employee ID or Social Security number on the pay stub as additional employee identification.

4. Pay type

Hourly or salaried? Pay type is how an employee’s pay is calculated. A salaried worker can expect the exact same amount of money for each paycheck, whereas an hourly employee’s wages will vary based on the number of hours the person works each pay period.

5. Pay date

The date that an employee receives a check is their pay date. Companies often pay their employees according to a regular schedule, such as every other Friday. That would make Friday an expected pay date.

6. Pay period

The pay period is the time frame during which an employee works. For instance, a biweekly pay schedule calculates a two-week, or 14-day, pay period.

7. Hours worked

The hours worked indicates the amount of time an employee spends at work. This varies for hourly employees. For salaried employees, a paycheck will typically cover all work completed within a 40-hour work week, or a typical 9 a.m. to 5 p.m. job.

8. Pay rate

The pay rate affects how gross pay is determined for hourly workers. For instance, an hourly worker may earn $20 per hour for a 40 hour work week. In this scenario, $20 is the pay rate.

9. Earnings

Earnings are also called gross wages. Gross wages are the full amount of money owed to an employee before expenses like taxes and deductions are taken out.

10. Taxes

The taxes that are taken out of gross wages are included on a pay stub. These taxes will show up on an employee’s W-2 later on for tax filing purposes. This money is sent to the government on an employee’s behalf by the employer.

There are three types of federal taxes that are withheld from pay: federal income tax, medicare, and social security. Many states withhold their own taxes, too.

11. Deductions

Deductions are optional withholdings from an employee’s pay. An employee can choose to deduct contributions to a retirement fund, a health care savings account, or other benefits. Deductions that are withheld pretax (from the gross income) have the great advantage of not being included in tax calculations.

12. Net pay

Net pay is what an employee gets to take home at the end of the day after taxes, deductions, and other withholdings. This dollar amount appears front and center on the check, and is the number most familiar to people.

13. Employer taxes

The employer also pays some taxes that the employee does not have to, such as the Federal Unemployment Tax Act. As a result, some companies include an employer tax section on their pay stub. This information shows the taxes that are taken from an employer, which does not impact net pay. Remember: This is the employer’s tax burden, not the employee’s.

14. Employer contributions

Another optional section, the employer contributions information on a pay stub, details how much the employer contributes toward benefits, including retirement and health care. Again, contributions from an employer don’t take away from an employee’s net pay.

What is a pay stub?

Paychecks include a pay stub to provide details about an employee’s pay. Employers can give their employees a printed or digital copy of their pay stub.

The information included on a pay stub varies, but most often it will include wages the employee earns for the current pay period and the year to date. There is often a section devoted to the tax breakdown, showing how much an employee pays for federal taxes, state taxes, medicare, and social security.

In addition, there is also a section that shows deductions for benefits. Common deductions include contributing to a company-sponsored retirement plan or a health savings account.

Most importantly, the pay stub shows the net pay, or total take-home pay that the employee receives.

Why are pay stubs used?

A pay stub includes important information for both employers and employees. It can also be used to complete an employee's W-2 forms during tax season.

Employees receive a pay stub as a financial record of being paid. It’s important for employees to understand the different parts of a pay stub to know that they are receiving the correct amount and there aren’t any errors in their taxes or deductions. Pay stubs can be used to settle concerns about an employee’s pay, should any issues arise.

Test your knowledge

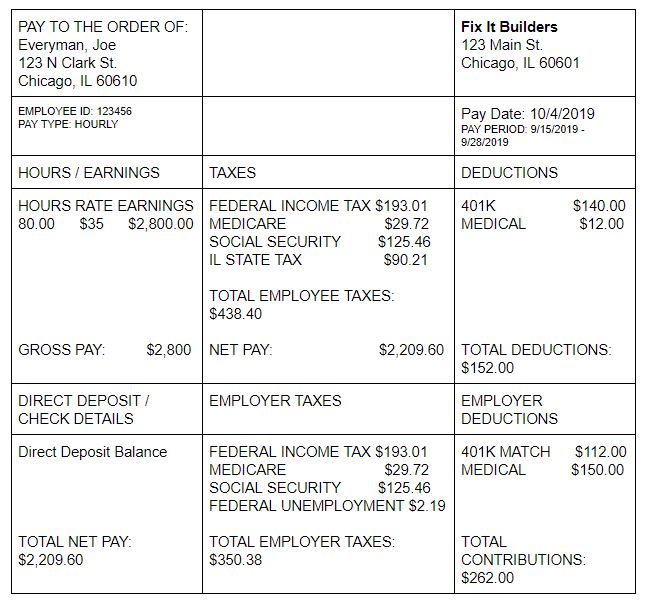

Instructions: Use the pay stub to answer the questions below. You can also download the pay stub worksheet here.

1. Who is the employee receiving the pay stub?

____________________________________________________________________________

2. When is the pay period of the pay stub?

____________________________________________________________________________

3. How much does the employee contribute to their 401(k)?

____________________________________________________________________________

4. How much does the employer pay in taxes?

____________________________________________________________________________

5. What is the total net amount of the employee’s paycheck?

____________________________________________________________________________