Sinking Funds 101

Sinking funds, nest eggs, emergency funds, savings, etc. It’s easy to become overwhelmed by trying to distinguish among the different kinds of savings accounts.

Here’s what’s great about sinking fund accounts: they serve specific purposes that you decide in advance.

Do you need to save for specific car repairs, like new brakes and tires, or a new car altogether? Do you anticipate the need for home repairs, a dream vacation or wedding, or Christmas gifts? Consider a sinking fund.

Sinking fund vs. savings account

As Dave Ramsey wrote:

“A sinking fund is for the known, and an emergency fund is for the unknown.”

Unlike a savings account or emergency fund, a sinking fund isn’t a catch-all to cover any type of unanticipated emergency. A sinking fund is given a very specific purpose; it isn’t meant for you to tap for a random occasion or emergency. By designating a certain amount of money and setting it aside each month, you can slowly save money for your predictable expenses.

“When I first started budgeting and analyzing where my money was going, I realized very quickly that certain expenses came up every year that impacted my budget significantly,” wrote Kumiko, accredited financial counselor and voice behind the Budget Mom.

If certain expenses are bound to come up every year, like holiday gifts or birthdays, Kumiko creates a sinking fund to make sure her monthly budget can help cover the costs when those times roll around.

Sinking funds for predictable emergencies

As conflicting as it may sound, having a sinking fund can help you plan for the unexpected expenses you know are already coming, such as out-of-pocket medical expenses, like a large annual insurance deductible) or replacing a broken furnace. Kumiko writes:

“We all know that life can throw us curve balls. You never know when, what, or how things will break or fall apart, but you know they will, eventually. Saving a small amount over time for unexpected curve balls: like a new roof, a new washer and dryer, or new tires, will make those circumstances and purchases a lot less stressful”

Ideally, the creation of a sinking fund means you have the amount of money you need for when something goes wrong. For example, if your dishwasher is on the fritz, creating a sinking fund for a replacement will prevent you from having to use a credit card or taking out a personal loan when your old one finally bites the dust. In a nutshell, your sinking fund account can help you avoid taking on new debt by addressing your foresight of needing a large chunk of money.

How do you create a sinking fund?

Creating a sinking fund can be as unique as your needs. For some, the idea of having envelopes full of cash lying around is worrisome, while others prefer having the actual cash in hand. Some may utilize a bank that allows them to open separate accounts to easily keep track of multiple savings goals, while others have one savings account and keep track of the allocations themselves.

Christine at The Mostly Simple Life cites the ledger method as one her mother used to keep track of sinking funds when she was growing up. She would track her sinking fund categories while using a singular bank account. Christine does the opposite now: She utilizes the separate accounts method to keep track of her little bundles of savings. She wrote the following:

“I can clearly see how much money I have saved in each sinking fund. You can easily set up an automatic deposit so that the savings is done for you.”

Not every bank allows multiple savings accounts, so check with your bank before deciding which method will best help you to set aside the money you will need.

How much do I need?

The amount you save is entirely dependent on your savings goals and the number of months you have to achieve them. If you’re saving for a dream vacation two years down the road versus birthday or holiday gifts, there’s bound to be a significant difference in how much you need to save.

Bola Sokunbi at Clever Girl Finance has some great tips for calculating exactly how much money you should set aside every month to reach your financial goals for your sinking funds:

“So, for example, you have your wedding anniversary coming up in 10 months. You find a great vacation spot that will cost you $2,000. Divide $2,000 by 10 and your monthly contribution into your anniversary sinking fund will be $200 for the next 10 months.”

Contributions can be as large or small as you can afford to accommodate your cash flow. What matters is that you’re sinking money into your funds now so you won’t be sinking into debt later on.

Resources to help you save

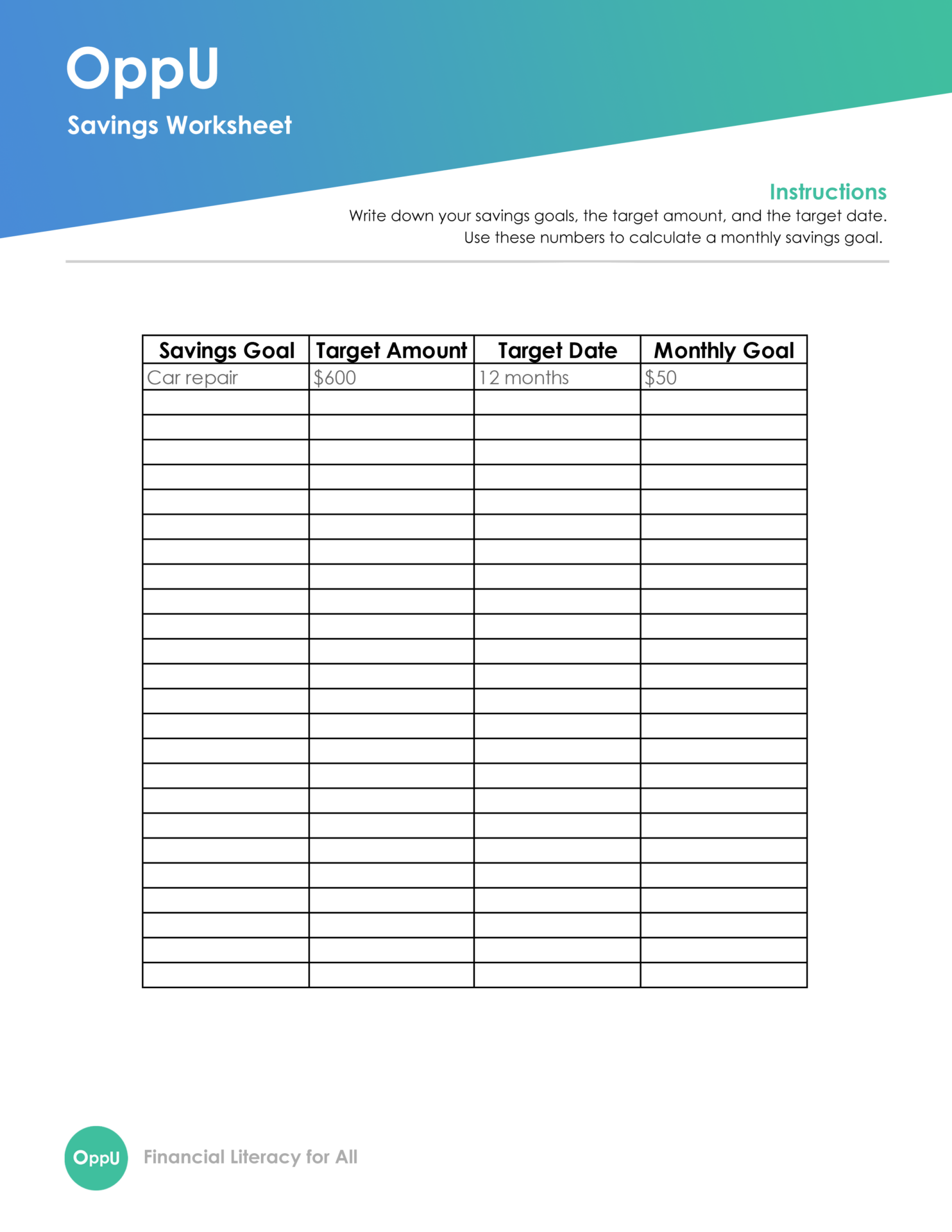

Need some additional help setting up your personal finance goals for your sinking funds? OppU has a blog post featuring tips to walk you through the process. There's also a free worksheet download. Here's a preview:

Please note the below article contains links to external sites outside of OppU and Opportunity Financial, LLC. These sources, while vetted, are not affiliated with OppU. If you click on any of the links you will be sent to an external site with different terms and conditions that may differ from OppU’s policies. We recommend you do your own research before engaging in any products or services listed below. OppU is not a subject matter expert, nor does it assume responsibility if you decide to engage with any of these products or services.