Climb Your Way Out of Debt: 4 Strategies to Try

While it’s common to have debt, it can seem like too big a burden to tackle, especially if you’re carrying over large or multiple balances from month to month.

Even before the coronavirus increased financial strain for households across the country, about a quarter of Americans who carried debt owed between $5,000 and $25,000, according to Northwestern Mutual’s 2020 Planning and Progress Study. Credit card debt and mortgages were the largest sources of debt.

However, the idea of paying down debt doesn’t have to make you feel hopeless.

If you have a goal to be debt-free, breaking this challenge down into smaller subgoals can be helpful. Achieving smaller, more manageable goals can help keep you driven to continue. For example, if you had a plan to lose weight, it would be easier to set a small goal to lose one pound per week than trying to lose 50 pounds in a year.

“If there’s any way to break down your goal into smaller subgoals that you can monitor, it can build momentum and motivation to continue,” says Remi Trudel, Ph.D., an associate professor of marketing at Boston University, who studies consumer behavior and has conducted research on debt repayment motivations.

Whichever debt payoff strategy you choose, it’s important to track your progress to keep yourself motivated, as choosing a debt payoff plan will require financial sacrifices.

Strategy No. 1: Debt snowball

The debt snowball method, popularized by Dave Ramsey, prioritizes paying down the account with the smallest debt -- or lowest balance -- first. With the snowball method, you pay the minimum payments on all your debts and then use extra money to pay the debt with the smallest balance.

“When you have more multiple debts, the evidence consistently shows that Dave Ramsey’s snowball method is more motivating,” says Trudel, whose research found that in some cases, people who paid down smaller debts first were able to get out of debt 15% quicker. Winning small kept people motivated toward their goal.

Using the debt snowball method isn’t for everyone. This method may not be the best option for those who have debt they’re unlikely to pay off because they don’t earn enough income to cover the costs. Consumers like this with severe debt may consider enrolling in a debt management plan through a nonprofit credit counseling agency, as they may be able to negotiate a better interest rate or repayment schedule.

Strategy No. 2: Debt avalanche

The most rational and optimal debt repayment strategy is the debt avalanche method. This method prioritizes eliminating compounding credit card interest.

With this strategy, consumers first pay down the debt with the highest interest rate while continuing to pay the minimum on all other outstanding balances.

Although the debt avalanche method will save you more money in the long run than the debt snowball method, the path has fewer short-term wins, so it can be difficult to stay committed to debt relief.

Strategy No. 3: Debt management plan

Nonprofit credit counseling agencies can provide support and expertise in the debt repayment process by offering debt management plans. Credit counselors can also help consumers address underlying financial issues and establish healthy financial habits.

In a National Foundation for Credit Counseling (NFCC) study, about 74% of those who sought credit counseling had a medium credit card debt level of $12,000.

“If you don’t address the underlying issues, then you’ll wind up in the same place again and damage your credit more,” says Peter Klipa, senior vice president of creditor relations at the NFCC. “We look at what got them in this financial difficulty to get to the heart of the issue.”

If you’re considering a debt management plan, a credit counselor will review your entire financial situation to determine if you qualify. These plans are specifically for credit card debts. They’re not for auto loans, mortgages, or student loans.

“Credit agencies evaluate your specific situation and come up with an action plan based on your finances,” Klipa says.

If a debt management plan is right for you, credit counselors will negotiate a manageable payment arrangement with your creditors. You will then make one monthly payment to your credit card companies at a standardized reduced interest rate through the credit counseling agency. You will still pay the full amount of the debt you owe, as most credit counseling agencies don’t recommend debt settlement. Plans have a set timeline of no more than 60 months.

Debt management plans can limit your access to credit, as credit counseling agencies advise customers to close out unnecessary credit card accounts and agree to stop charging on their cards. Credit counselors also charge a monthly fee to participate in their program.

For consumers who may lack the organization and discipline to stick to a plan on their own, a credit counseling agency may be their best option.

Strategy No. 4: Debt consolidation loan

You may consider debt consolidation if you find a personal loan with a lower interest rate than the interest charges on your balances.

When inquiring about personal loans, financial institutions will look at your credit score, income, and other personal information to determine if you qualify for one. Once you find the right lender, you can use the money from the debt consolidation loan to pay off your outstanding balances. All of your individual debts will then turn into one payment with a single interest rate. A debt consolidation loan can help you have a consistent monthly payment, so you don’t need to keep track of multiple credit card debts.

According to a TransUnion study, people who took out debt consolidation loans paid down about 58% of their overall credit card debt. After taking out the loan, consumers' average credit card debt decreased from $14,015 to $5,855.

Consolidating your debt into one big account can slow your debt repayment progress, Trudel says. Consumers who used this method weren’t as successful at staying motivated for the cause. It makes it harder to see progress, so It may be better to choose another debt repayment strategy.

There is also a similar option of opening a balance transfer credit card, which allows you to transfer credit card balances to a new card with a lower interest rate. However, you do have to watch out for balance transfer fees, in addition to the terms of the lower rate, to make sure you aren’t paying more in the long term.

Resources

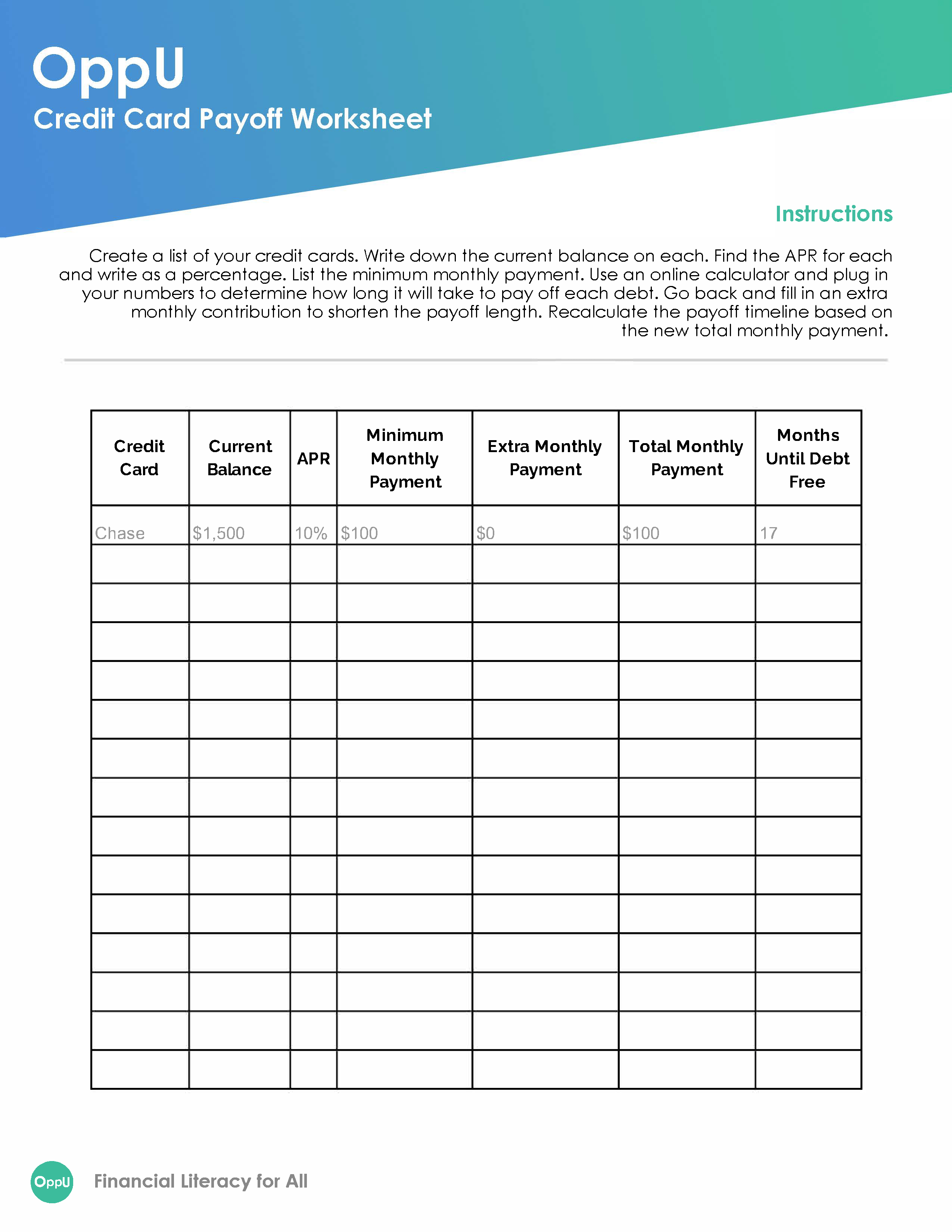

Sometimes having a guide to help visualize your goals and plan can be helpful. This worksheet from OppU, which you can download here, can serve as a tool to help you organize and pay down your credit card debt, or any other debts you may have. More information about how to strategize with this tool can be found here.