About Us

OppFi is a leading tech-enabled digital finance platform that works with banks to provide financial products and services for everyday Americans. Through a transparent and responsible platform, which includes financial inclusion and excellent customer experience, the Company supports consumers who are turned away by mainstream options to build better financial health.

What Our Customers Are Saying

Our customers’ success is our greatest achievement. Here’s what they have to say about OppLoans:

Our Commitment to Financial Health

OppFi is a Member of the Financial Health Network, joining leading-edge financial services, financial technology, and other providers committed to improving financial health for all.

Improve Credit: Tools that can help increase your FICO® Score instantly

Financial Education: Learn financial skills and earn rewards in the process

Local Savings: Discover local resources to save on rent, utilities, and more

Why Choose Us?

Millions of Americans are underserved by traditional financial institutions due to limited or poor credit histories.

Our approach fills that gap with an innovative, customer-first focus:

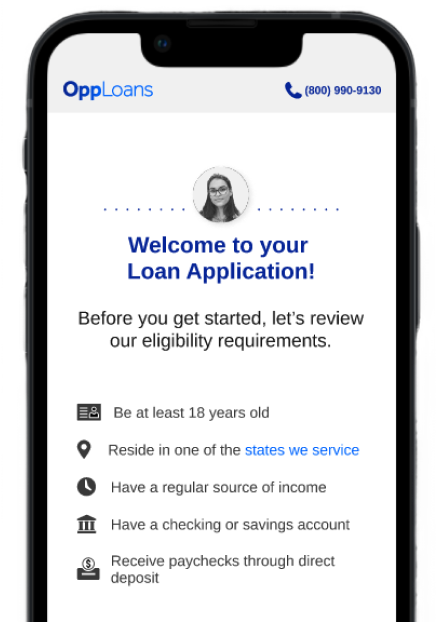

Simple Loan Application Process

Working with community banks, the OppLoans platform offers personal loans designed to fit your needs. The process is simple and built around you:

-

Apply Online

The application process is quick and easy, with decisions often made in minutes. -

Approval Process

Our Bank Partners consider more than just your credit score, so even if you’ve been turned down by others, you may still qualify. -

Same-Day Funding Available

If approved, you may receive money in your account as soon as the same business day1!

OppLoans Has Served 2M+* Customers

Over 13+ Years

*As of December 31, 2024

Join the OppFi Team!

We offer a great compensation and benefits package to support you inside and outside of work as you grow your career with us.