Installment Loans

Applying for an online installment loan should be quick, seamless, and easy -- and so should your repayment process.

Applying does NOT affect your FICO® credit score.2

The figures above are examples of our lending partner’s typical installment loan offers and do not serve as guarantee of any rates & terms that you may qualify for.

Testimonials reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans.

What Is an Installment Loan?

In a nutshell, an installment loan is a type of personal loan that borrowers typically pay off in equal monthly installments until the debt has been repaid in full. That means the borrower pays the same amount of money each month on a predetermined date.

Installment loans come in many forms. Certain auto loans or home loans take the form of installment loans. You can also take out a personal installment loan to cover emergencies, medical bills, debt consolidation, or large purchases. No matter your financial goals, a borrower pays off an installment loan in fixed monthly payments.

Simple Loan Application Process

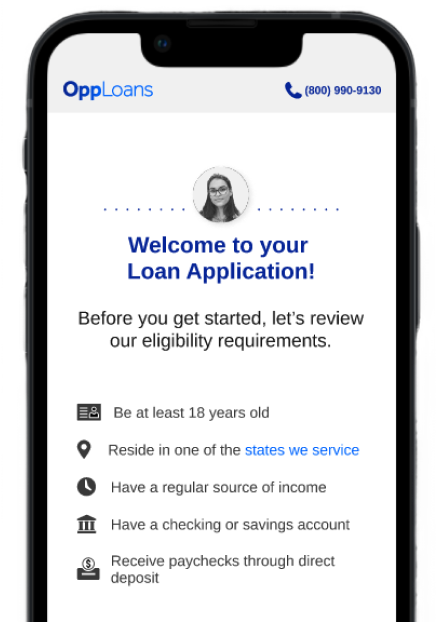

Working with community banks, the OppLoans platform offers personal loans designed to fit your needs. The process is simple and built around you:

-

Apply Online

The application process is quick and easy, with decisions often made in minutes. -

Approval Process

Our Bank Partners consider more than just your credit score, so even if you’ve been turned down by others, you may still qualify. -

Same-Day Funding Available

If approved, you may receive money in your account as soon as the same business day!1

How Do I Apply for an Installment Loan?

Applying does NOT affect your FICO® credit score!2

Comparing Installment Loan Options

Take charge of your finances by choosing a loan that puts you in control. Identify which installment loan best fits your needs by comparing payment schedules, interest rates, and terms.

Reclaim your financial future by finding the best personal installment loan for you.

- Accessibility: The installment loan should give you access to the funds you need, where you need it.

- Type of loan: Installment loans can be secured or unsecured. Secured loans require collateral such as an automobile, whereas unsecured loans do not require collateral.

- Repayment terms: Your monthly loan repayments should fit nicely into your budget. Affordable repayments can help you successfully pay off your loan.

- Annual percentage rate (APR): Check to see if your lender charges prepayment fees, late fees, or origination fees.

- Credit building opportunities: Paying on-time should earn you the credit you deserve and may be able to boost your credit score. Choose a lender who reports repayments to the credit bureaus.

FAQs

Champion your finances with an installment loan. Making on-time monthly payments with the right lending partner may give you the opportunity to build your credit history. Installment loans offer borrowers consistent monthly payments, so you know exactly how much your next payment will be.

At OppLoans, we believe every borrower has the opportunity for a better financial future. Bad credit isn't the end of your story. Before making a loan offer, OppLoans takes into account your employment or income status, good standing with other lenders, and on-time payment history.2

OppLoans does not run a hard credit inquiry with the three major credit bureaus. Instead, we partner with a credit bureau that won’t impact your FICO score when providing us with your credit history.2

Our application process is entirely online to make borrowing convenient.

Depending on your state and your income, you may qualify for a loan between $500 and $5,000.4 Your loan amount will be determined by several factors, including your state of residence, income, ability to repay, and creditworthiness.5

For more information about the product options and lender(s) in your state, please visit our Rates and Terms page.