No Credit Check Loans

We understand a low credit score can make it difficult to get an affordable loan, so our Bank Partners do not base funding decisions exclusively on FICO® credit scores obtained from a hard credit check. The OppLoans Platform doesn't offer a No Credit Check Loan; instead, our Bank Partners perform a soft credit check.2

Testimonials reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans.

What is a no credit check loan?

A no-credit-check loan, also referred to as a loan with no credit check, is a type of loan that typically doesn’t require a hard FICO score credit check from the applicant. This can be appealing to potential borrowers who are concerned about having bad credit or a poor credit history.

A no-FICO-credit-check loan may seem like a good fast-cash option, but there are always risks -- particularly if you are unable to fulfill your repayment obligations. Educating yourself is the best way to make the right borrowing decision for you.

How can I get a loan with no credit check?

There are a variety of lenders and financial institutions that provide small-dollar loan options without requiring a look at your credit score. It’s important to research your options before applying for one of these loans, even if it’s an easy, online loan application. Applying for too many loans in a short period of time can still flag you as a risky borrower to lenders, even if they aren’t looking at your FICO score.

Lenders perform credit checks to help make decisions about whether or not potential borrowers are likely to repay their personal loans. While we don’t check your FICO credit score at OppLoans, we want to make sure we set you up for success to make on-time monthly payments. Looking at your credit history can help us do that.2

Will OppLoans check my credit when I apply for an online loan?

When applying with OppLoans, we don’t perform a hard credit inquiry on your credit report. Instead, OppLoans uses credit report information provided by Clarity Services and Experian, which does not impact your credit score or appear on your credit report.2 Our Bank Partners make lending decisions based on an applicant’s overall creditworthiness and ability to repay.

Ultimately, we want to set our customers up for success in their financial lives. We report loan repayments to the three major credit bureaus, so every borrower has the opportunity to build their credit history.

What does OppLoans consider when looking at my credit history?

During the credit review process, we consider multiple factors to assess a borrower’s income, ability to repay, and creditworthiness, including, but not limited to, your:

- Employment status

- Income details

- Bank account

- Financial history

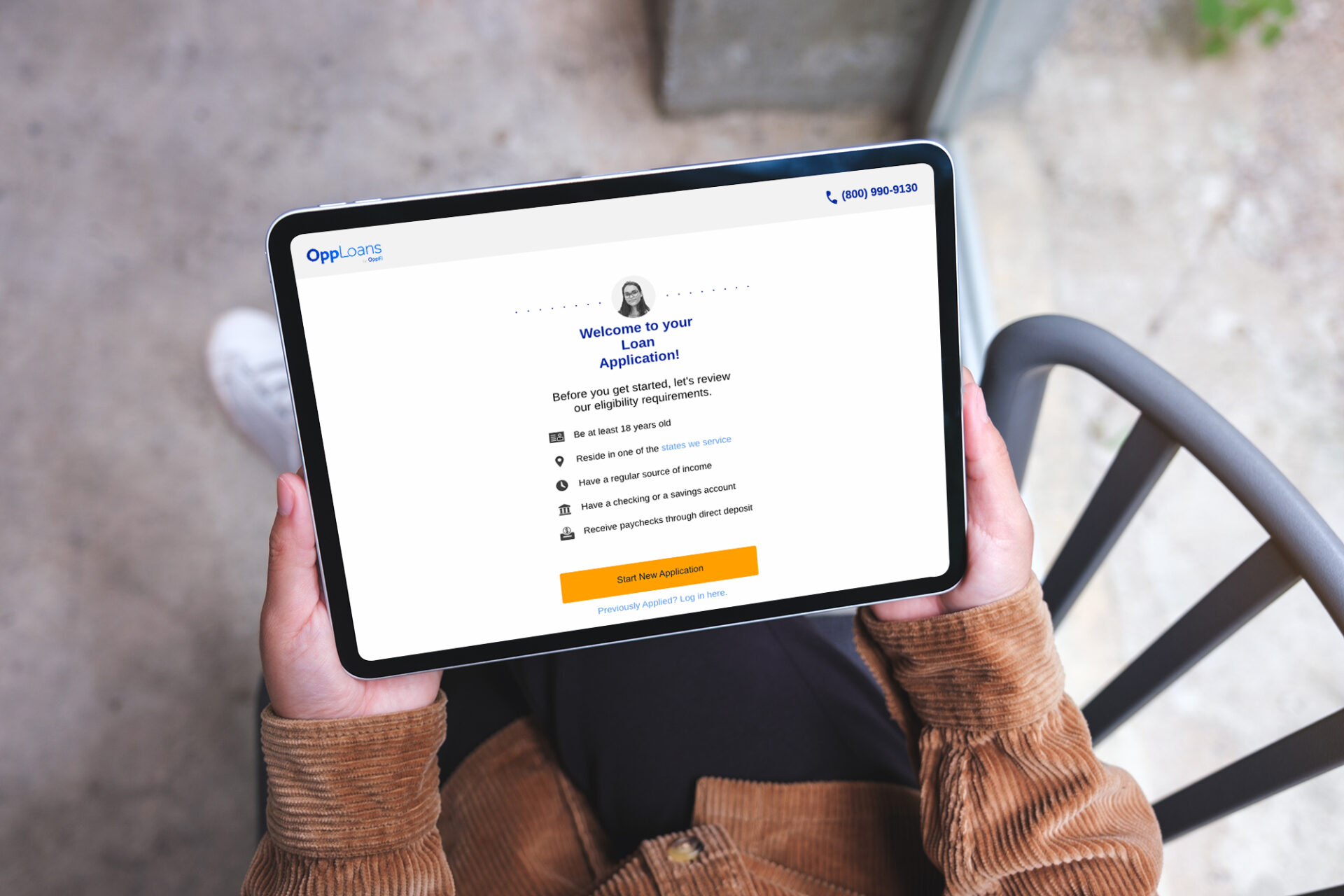

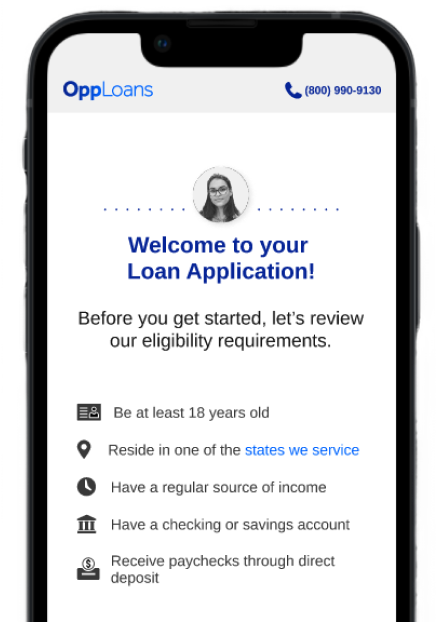

Simple Loan Application Process

Working with community banks, the OppLoans platform offers personal loans designed to fit your needs. The process is simple and built around you:

-

Apply Online

The application process is quick and easy, with decisions often made in minutes. -

Approval Process

Our Bank Partners consider more than just your credit score, so even if you’ve been turned down by others, you may still qualify. -

Same-Day Funding Available

If approved, you may receive money in your account as soon as the same business day!1

How do loans through OppLoans work?

Applying does NOT affect your FICO® credit score!2

FAQs

Our online loans are considered unsecured loans. We do not require collateral to secure our loans.

Funds may be deposited for delivery to your bank via ACH as soon as the same business day if verification is completed and final approval occurs before 12:00 PM CT on a business day. If approval occurs after 12:00 PM CT on a business day or on a non-business day, funds may be delivered as soon as the next business day. Availability of the funds is dependent on how quickly your bank processes the transaction.

OppLoans does not charge prepayment fees. Rates and terms on loans offered through OppLoans vary by state. You can learn more about OppLoans rates and terms here.