Online Loans

Designed for You

- Same-day funding available.1

- Applying does NOT affect your FICO® credit score.2

- No hidden fees.

Testimonials reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans.

Simple Loan Application Process

Working with community banks, the OppLoans platform offers personal loans designed to fit your needs. The process is simple and built around you:

Apply Online

The application process is quick and easy, with decisions often made in minutes.Approval Process

Our Bank Partners consider more than just your credit score, so even if you’ve been turned down by others, you may still qualify.Same-Day Funding Available

If approved, you may receive money in your account as soon as the same business day!1

Read What People Are Saying

The testimonials on our third-party review websites reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans.

Why OppLoans Is Right For You

FAQs

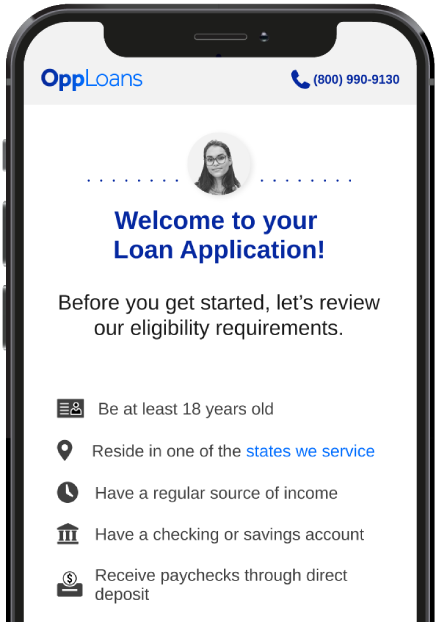

The first step in applying for a loan through OppLoans is to fill out our online loan application. To be eligible for a product through the OppLoans platform, potential borrowers must:

- Be 18 years or older

- Have a bank account (checking account or saving account)

- Reside in one of the states in which we currently operate

- Have a regular source of income (Income can be from employment or from benefits including Social Security, Disability, etc. Please note: alimony, child support, or separate maintenance income is optional to include)

- Receive income through direct deposit

Consumer products offered through the OppLoans website range from $500 to $5,000, but your eligibility will depend on your state of residence, income, ability to repay, and creditworthiness.

For more information about the product options and lender(s) in your state, please visit our Rates and Terms page.

We truly care about our customers and work hard to be flexible for each of our customer's unique situations. We want to make sure borrowers get the best loan from one of our bank partners made through the OppLoans Platform.

Unlike some financial institutions (and quite unlike payday loans5), bank partners don't charge origination fees or prepayment fees on loans originated through the OppLoans Platform. Loans originated through the OppLoans Platform charge simple, fixed rate interest and contain no hidden fees.

Loans made by our bank partners through the OppLoans Platform do not base funding decisions exclusively on FICO credit scores or credit history.

Further, OppLoans reports payments to all three major credit bureaus to help borrowers in good standing build their credit history.6

Online personal loans are unsecured installment loans offered by some online lenders and traditional banks. Broadly, online credit products may take the form of a line of credit, a cash advance, or other loan options.

Online personal loan offers should clearly disclose the loan's APR (annual percentage rate), the term, and any fees such as finance charges.

Online personal loans can be used for a wide variety of family and household purposes. Maybe you're looking for a loan to help consolidate debt from multiple credit cards, or maybe you need to fund an expensive home improvement or car repair. Also, if you're looking to turn bad credit into good credit, the right online personal loan may help you do that.

OppLoans customers have used their loan amounts for:

Whatever your reason for searching online lenders (and whether you have excellent credit, bad credit, or you land somewhere in the middle), there are terms and conditions of the loan that you'll want to understand. Borrowers should always be clear on the interest rate, repayment terms, and whether or not the lender will run a hard or soft credit check.

OppLoans believes in matching borrowers with the best possible loan for them. If we're able to provide you with an online personal loan product, we want to make sure your repayment options are both clear and affordable across the life of the loan term.

OppLoans offers multiple recurring payment options including ACH and paper check options. For single payments, debit cards are also accepted.

For more details, see our FAQ: How Can I Repay My Online Personal Loan?