Loans for Bad Credit

We understand a low credit score can make it difficult to get an affordable loan so our Bank Partners do not base funding decisions exclusively on FICO® credit scores. OppLoans' Bank Partners perform a soft credit check when you submit an application.2

Applying does NOT affect your FICO® credit score.2

The figures above are examples of our lending partner’s typical installment loan offers and do not serve as guarantee of any rates & terms that you may qualify for.

Testimonials reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans.

What are Bad Credit Loans?

A bad credit loan is for someone whose credit score isn’t high enough to receive a loan from a traditional financial institution. The OppLoans platform does not offer Bad Credit Loans. Instead, the products offered through our platform look beyond your FICO credit score to analyze your overall creditworthiness when it comes to an online personal loan. The credit check we perform on behalf of our bank partners will not appear as a hard credit inquiry on your credit report, so applying won’t negatively impact your FICO score.2

What Is Considered Bad Credit?

In a nutshell, bad credit is when your credit score is too low for you to qualify for a standard loan. A bad credit score is typically considered a FICO score under 670. Your payment history and credit utilization are two of the major factors used to determine your credit score.

Missed payments, maxing out your credit cards, and filling out too many loan applications are unhealthy financial habits that can hurt your credit score and stand in the way of obtaining credit. Unfortunately, lenders view borrowers with low credit scores as less likely to pay back their debts.

But bad credit scores don't have to hold you back. We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on FICO® credit scores2 or credit history.

Why Choose OppLoans for a Loan if You Have Bad Credit?

If you have bad credit, we may be able to help you! Through our commitment to customer service and our bank partners, we help consumers turned away by traditional providers be empowered to improve their financial health. Here are just a few reasons to choose the OppLoans platform for your funding needs:

Simple Application Process for Bad Credit Loans

Working with community banks, the OppLoans platform offers personal loans designed to fit your needs. The process is simple and built around you:

Apply Online

The application process is quick and easy, with decisions often made in minutes.Approval Process

Our Bank Partners consider more than just your credit score, so even if you’ve been turned down by others, you may still qualify.Same-Day Funding Available

If approved, you may receive money in your account as soon as the same business day!1

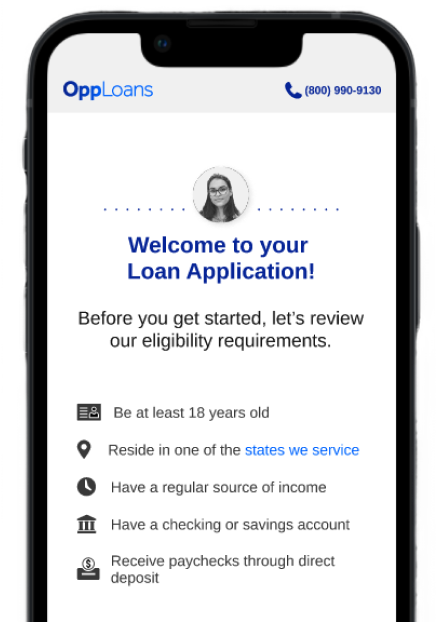

Our Loan Application Process

Applying does NOT affect your FICO® credit score.2

What Should Be Considered When Choosing a Loan for Bad Credit?

You don’t have to struggle to find a bad credit loan. Below are a few factors to consider when applying for a loan with bad credit:

- Repayment terms: Your monthly loan repayments should fit nicely into your budget. Affordable repayments can help you successfully pay off your loan.

- Fees and penalties: Prepayment penalties, late fees, and origination fees.

- Annual percentage rate (APR): APR stands for Annual Percentage Rate and is your true cost of credit stated on an annual basis.

- Credit building opportunities: Paying on time should earn you the credit you deserve. Choose a lender who reports repayments to the credit bureaus.

Comparing Your Bad Credit Loan Options

Doing your homework before applying for a bad credit loan can make getting a loan hassle-free.

FAQs

When matched with the right lender, a bad credit loan is comparable to a standard online personal loan. OppLoans works with Bank Partners that offer online personal loans designed to give you an affordable monthly repayment. Most of the loans typically have an 18-month repayment term, depending on the state you live in.4 Find out the specific rates and terms in your state here.

OppLoans only works with Bank Partners that do not do a hard credit inquiry during the loan application process. When you apply for a loan through our OppLoans platform, your credit score is not affected.2

Depending on your state and your income, you may qualify for a loan between $500 and $5,000.4 Your loan amount will be determined by several factors, including your state of residence, income, ability to repay, and creditworthiness.5

For a state-by-state guide, please visit our Rates and Terms page.

Our Bank Partners don't have a minimum FICO or Vantage score to qualify for the loan. Instead, they look at various factors from the alternate credit bureaus and your bank data to determine your eligibility.

When you receive your funds will vary based on the time at which your application was approved. You will receive an email notification once your loan is approved.

Funds may be deposited for delivery to your bank via ACH as soon as the same business day if verification is completed and final approval occurs before 12:00 PM CT on a business day. If approval occurs after 12:00 PM CT on a business day or on a non-business day, funds may be received as soon as the next business day.

Availability of the funds is dependent on how quickly your bank processes the transaction. If the funds have not been deposited by your expected funding date, please call us at (800) 990-9130 to verify your banking details are correct.

To check the status of your application, log in here.